Core Laboratories Inc. Sees Strong Stock Performance Amid Global Growth

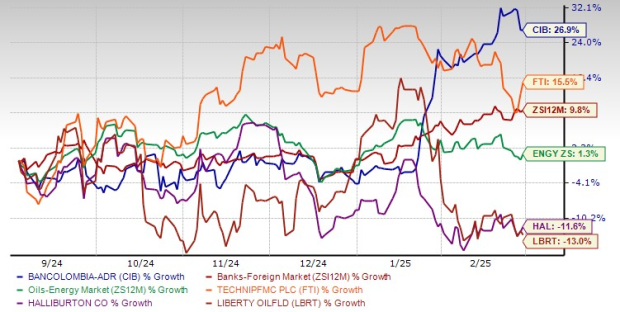

Core Laboratories Inc. (CLB), a prominent player in the oilfield services sector, operates in over 50 countries with a focus on reservoir management and production enhancement. Over the last six months, CLB’s shares have surged by 26.9%, significantly outpacing the broader oil and energy sector, which only saw a 1.3% increase. The stock has also outperformed the Field Services sub-industry and competitors, such as TechnipFMC (FTI) with a gain of 15.5%, and Halliburton (HAL) and Liberty Energy (LBRT), which recorded declines of 11.6% and 13%, respectively.

6-Month Price Performance Comparison

Image Source: Zacks Investment Research

Given CLB’s stock performance, investors are examining the factors contributing to its success and the suitability of an investment at this time. Here’s an analysis of what is bolstering the stock and the potential risks involved.

Factors Driving CLB’s Success

Strong International Growth: CLB’s Reservoir Description segment is reaping benefits from booming international and offshore drilling activities, as approximately 80% of revenues are generated outside the U.S. Despite facing challenges from reduced domestic land activities and geopolitical tensions, the company has effectively enlarged its global footprint, particularly in the Middle East. Its advanced laboratory capabilities and technology make CLB a preferred partner for both national oil companies and major operators. Opportunities in offshore projects across the South Atlantic Margin, North and West Africa, Norway, and the Asia Pacific region indicate further revenue growth potential.

Robust Free Cash Flow Enhances Shareholder Returns: CLB has demonstrated a solid ability to generate free cash flow (FCF). In 2024, the company reported $43.4 million in FCF, marking a 200% increase year-over-year, despite facing industry challenges. This solid cash flow allows for share buybacks, dividends, and reinvestment in technology without relying heavily on borrowing, as CLB strives to maintain an asset-light model to ensure steady cash flow and shareholder returns.

Image Source: Core Laboratories Inc.

Advancements in Proprietary Technologies: CLB leads the way in reservoir evaluation technologies featuring proprietary innovations such as Nuclear Magnetic Resonance (NMR) technology and FlowProfiler tracers. These advancements enable operators to distinguish between movable and immovable hydrocarbons, significantly enhancing hydrocarbon recovery and optimizing well performances. With ongoing investment in advanced diagnostic tools, CLB maintains a considerable competitive edge in the energy sector.

Asset-Light Business Model: CLB’s asset-light approach means that heavy capital expenditures are not necessary for business sustainability and growth. This model supports robust profit margins, maximizes free cash flow, and produces high returns on invested capital. Focusing on capital efficiency and controlling costs enables CLB to weather downturns more effectively than capital-intensive competitors.

Long-Cycle Offshore Project Opportunities: Headquartered in Houston, TX, CLB is well-positioned to benefit from consistent offshore developments, including significant projects in the South Atlantic Margin, West Africa, and the Middle East. These areas provide stability amidst uncertainties in the U.S. onshore environment. As international activities remain steady, CLB could achieve mid-single-digit growth in its Reservoir Description segment.

Potential Risks for CLB Stock

Competitive Pricing Pressure: While CLB offers high-quality proprietary technology in the Production Enhancement Segment, it encounters fierce competition in the perforating and well-completion markets. Many operators tend to prioritize cost over technology, causing pricing pressures that can restrict CLB’s margin expansion. This trend may continue to adversely affect profitability, especially if lower-cost competitors capture more market share.

Declining U.S. Onshore Activity Impacting Revenue: Production Enhancement revenues took a 7% dip sequentially in the fourth quarter of 2024, reflecting weak U.S. land completion activity. The U.S. Energy Information Administration forecasts minimal growth in U.S. oil production from 13.2 million barrels per day in 2024 to 13.5 million barrels per day in 2025. With stable to slightly declining drilling activity in the U.S., CLB’s Production Enhancement sector may struggle to recover from revenue losses.

Volatility of Oil Prices and Industry Cyclicality: As a service provider to the oil and gas industry, CLB’s financial performance is closely linked to fluctuations in oil prices and exploration spending. A significant drop in oil prices could lead operators to curtail exploration and development expenditures, resulting in diminished demand for CLB’s services. This reliance on cyclical industry trends introduces uncertainty for investors.

Short-Term Setbacks: Despite a constructive long-term outlook, short-term capital expenditure reductions by oil companies due to concerns regarding oil price fluctuations and economic uncertainty may affect demand for CLB’s services. Any pullback in global upstream spending could decelerate revenue growth within its Reservoir Description segment.

Geopolitical Risks and Sanctions Affecting Operations: The expansion of U.S. sanctions early in 2025 has disrupted crude assay laboratory services and sales in vital international markets. Restrictions on maritime movement and trading of crude oil have directly impacted CLB’s Reservoir Description operations, reducing demand for crude oil analysis services. With increasing geopolitical tensions in locations such as Russia, Ukraine, and the Middle East, CLB’s international operations face heightened risks of disruption.

Final Considerations for CLB Stock

CLB stock presents various positive aspects, including strong international growth, with 80% of its revenue derived from markets outside the U.S., particularly in the Middle East and offshore regions. The company’s advanced reservoir evaluation technologies, such as NMR, provide a distinct competitive advantage in hydrocarbon recovery. The outlook remains cautiously optimistic for Core Laboratories Inc. as it navigates a complex industry landscape.

Core Laboratories Faces Market Pressures Despite Strong Performance

Core Laboratories Inc. (CLB) operates an asset-light business model, which allows the company to maintain strong margins and achieve high returns on investment. This structure not only supports solid free cash flow but also enables funding for share buybacks, dividends, and investments in new technologies. However, as promising as these aspects are, CLB is not without its challenges.

Market Risks and Operational Concerns for CLB

The company is facing several risks that could affect its performance in the market. Notably, pricing pressures are prevalent in the perforating and well completion segments. Additionally, a decline in U.S. onshore activity, coupled with fluctuating oil prices and geopolitical uncertainties, has the potential to impact CLB’s international operations significantly.

Considering these risks alongside potential benefits, investors are advised to exercise caution. It may be prudent to wait for a more favorable market condition before adding this Zacks Rank #3 (Hold) stock to their portfolios.

Zacks Investment Research Highlights

For those interested in potential investments, Zacks has recently released its Top 10 Stocks for 2025. Curated by Zacks Director of Research Sheraz Mian, this portfolio boasts a remarkable performance history. Since its inception in 2012 through November 2024, the Zacks Top 10 Stocks portfolio has gained an astounding 2,112.6%, greatly surpassing the S&P 500’s return of +475.6% during the same period. This selection of stocks aims to deliver substantial growth, making it a compelling option for investors.

Looking for recommendations? Download Zacks’ 7 Best Stocks for the Next 30 Days for free.

Halliburton Company (HAL) : Free Stock Analysis Report

Core Laboratories Inc. (CLB) : Free Stock Analysis Report

TechnipFMC plc (FTI) : Free Stock Analysis Report

Liberty Energy Inc. (LBRT) : Free Stock Analysis Report

This article was originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the author’s own and do not necessarily reflect those of Nasdaq, Inc.