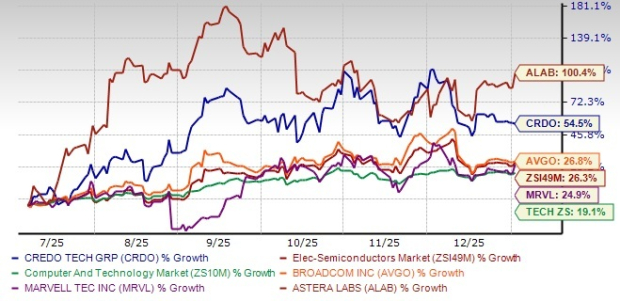

Credo Technology Group Holding Ltd (CRDO) has experienced a significant 54.5% surge in stock price over the past six months, surpassing the Electronic-Semiconductors sector’s growth of 26.3% and the broader Computer and Technology sector’s 19.1%. This uptick is largely attributed to increased demand for high-speed, energy-efficient data center connectivity, driven by advancements in AI infrastructure.

In its latest quarter, Credo reported more than 10% revenue contributions from four major hyperscalers, indicating robust adoption of its Active Electrical Cables (AECs), which provide up to 1,000 times more reliability and 50% lower power consumption compared to optical solutions. The company anticipates third-quarter revenues between $335 million and $345 million and expects year-over-year growth exceeding 170% in fiscal 2026.

Despite strong performance, CRDO faces competitive pressures from companies like Broadcom and Marvell Technology. It currently trades at a forward price/sales ratio of 17.22, a premium compared to its sector’s average of 8.58, reflecting its growth potential. Investors are advised to monitor evolving market conditions while considering CRDO’s outlook.