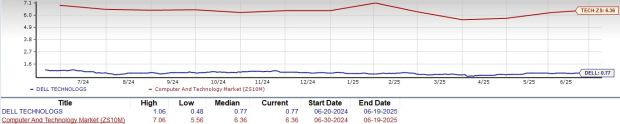

Dell Technologies (DELL) stock is currently priced significantly lower with a forward 12-month price-to-sales ratio of 0.77, compared to the sector average of 6.36. The company has seen a year-to-date share price increase of 1.2%, lagging behind the Computer and Technology sector’s 1.6% rise.

Despite challenges in the PC market and a competitive environment with firms like HP and Lenovo, Dell’s AI-optimized servers generated $12.1 billion in orders during Q1 of fiscal 2026. Revenue for the upcoming Q2 is projected between $28.5 billion and $29.5 billion, reflecting a 16% year-over-year increase, with expected earnings of approximately $2.25 per share. The Zacks Consensus Estimate points toward a revenue of $29.09 billion and a year-over-year growth of 16.23%.

Partnerships with companies like Lowe’s and NVIDIA have strengthened Dell’s market position, particularly in AI infrastructure development. The demand for Dell’s AI servers contributed to healthy backlog figures of approximately $14.4 billion.