Dynatrace Outperforms Market Amid Challenges: A Look at Recent Developments

Stock Performance Highlights

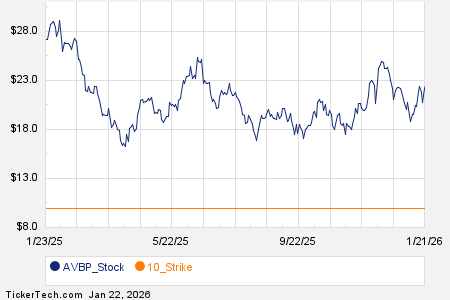

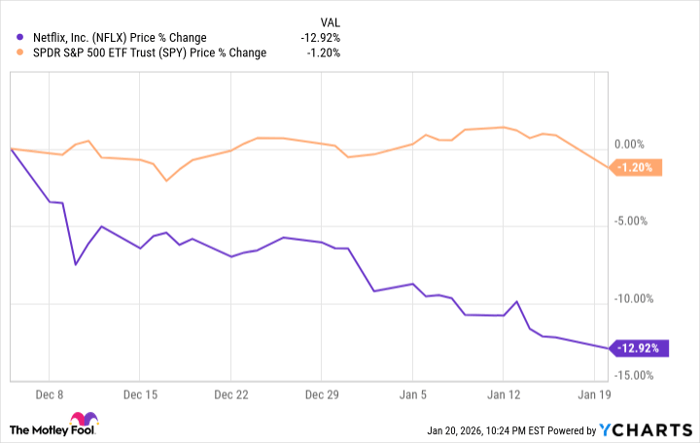

Dynatrace’s DT shares have increased by 16.5% over the last six months, significantly surpassing the Zacks Computer & Technology sector’s return of 1.1% and the Zacks Computers – IT Services industry’s growth of 12.5%.

The company also outperformed competitors such as Clarivate CLVT, which experienced a decline of 11.7% during the same timeframe.

This rise in DT’s shares is primarily due to solid performance metrics, strong AI-powered platforms, and ongoing product innovation, resulting in consistently impressive quarterly results. In fact, over the past four quarters, the company has exceeded Zacks Consensus Estimates for both revenue and earnings.

Despite these successes, Dynatrace grapples with hurdles, such as slower-than-expected customer growth and challenges in client acquisition strategies. The increasing competition within the AI-driven observability market raises concerns about preserving market share and pricing power.

Dynatrace, Inc. Price and Consensus

Dynatrace, Inc. price-consensus-chart | Dynatrace, Inc. Quote

Even with the mentioned challenges, Dynatrace remains positive about future growth prospects, concentrating on AI-driven observability, enhancing partnerships, and refining its market strategies.

Expanding Partner Network for Growth

Dynatrace has established an extensive Partner Program that merges its observability, application security, and AIOps capabilities with leading partner solutions. This strategy permits partners to seamlessly integrate the DT platform into their offerings, enhancing value for clients.

In a notable partnership, the company has integrated its AI-powered observability platform with Microsoft Azure, a cloud service from Microsoft MSFT. This partnership aids in smooth cloud transformations for enterprises, allowing them to utilize Dynatrace’s solutions within the Azure framework.

Additionally, Dynatrace has strengthened its go-to-market collaboration with Alphabet’s GOOGL cloud platform, Google Cloud, enabling customers to implement Dynatrace solutions on this platform. This cooperation fosters digital transformation by providing AI-driven analytics and automation tools.

Key customer wins include an eight-figure TCV expansion deal with a major U.K. digital bank and a seven-figure DPS extension with a large U.S. airline, which has notably reduced resolution times from over an hour to fewer than five minutes.

AI Enhancements Drive Strong Growth Potential

Dynatrace has doubled down on its focus on AI-driven observability by launching advanced log management and analytics, while also incorporating AI enhancements to boost platform usability and user experience.

The company employs three major AI techniques: causal AI, predictive AI, and generative AI. Causal and predictive AI have been integral to the platform for more than ten years. Recently, Dynatrace introduced AI Observability for Large Language Models and Generative AI, enabling organizations to efficiently monitor and optimize AI models in their applications.

Recognized as a leader in the 2024 Gartner Magic Quadrant for observability platforms for the 14th consecutive time, Dynatrace showcases its strong market presence.

Notably, Dynatrace added 143 new customers in the second quarter of fiscal 2025, albeit slightly below expectations, indicating some difficulties in attracting new clients.

The higher ratio of less experienced sales representatives may impact short-term productivity, necessitating focused training to sustain sales momentum.

Positive Outlook for Fiscal Year 2025

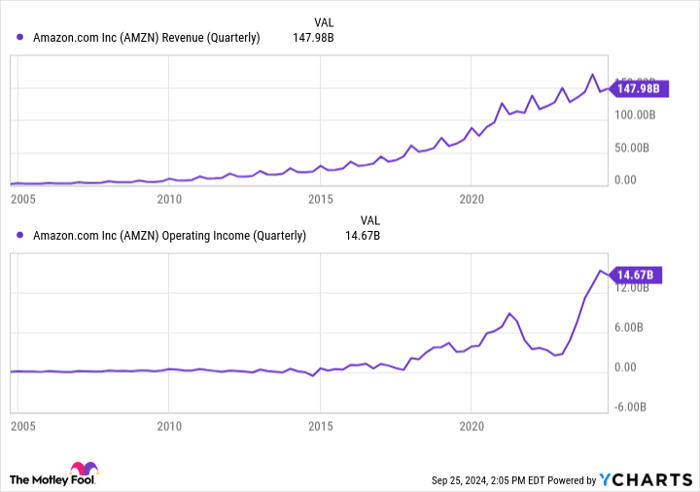

For the fiscal year 2025, the company forecasts total revenues between $1.67 billion and $1.68 billion.

The Zacks Consensus Estimate for revenues stands at $1.67 billion, projecting a year-over-year increase of 16.83%.

Expectations for non-GAAP earnings range from $1.31 to $1.33 per share. The consensus estimate for fiscal 2025 earnings is $1.32 per share, unchanged over the past month and suggesting a rise of 10% from the previous year.

Dynatrace has consistently surpassed the Zacks Consensus Estimate in the last four quarters, with an average earnings surprise of 13.71%.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Final Thoughts

Given Dynatrace’s strong position in AI-driven observability, a solid partner network, and expanding customer base, the company shows promising long-term potential.

However, with current customer acquisition challenges and sales productivity concerns, investors may want to be cautious and consider waiting for a better entry point.

Dynatrace has a Zacks Rank #3 (Hold). View the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Explore Today: Harnessing the Power of Nuclear Energy

The demand for electricity continues to rise dramatically, and there is a pressing need to reduce reliance on fossil fuels like oil and natural gas. Nuclear energy emerges as an optimal alternative.

Recently, leaders from the U.S. and 21 other nations pledged to triple the world’s nuclear energy capacity. This ambitious transition could yield significant profits for nuclear-related companies — especially for investors who act swiftly.

Our urgent report, Atomic Opportunity: Nuclear Energy’s Comeback, examines the key players and technologies propelling this opportunity, featuring three standout stocks likely to benefit the most.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today. Additionally, get insights on Zacks Investment Research’s latest recommendations by downloading 7 Best Stocks for the Next 30 Days.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Dynatrace, Inc. (DT): Free Stock Analysis Report

Clarivate PLC (CLVT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.