Analysts Project Notable Upside for Invesco S&P 100 Equal Weight ETF

According to recent research from ETF Channel, the Invesco S&P 100 Equal Weight ETF (Symbol: EQWL) holds potential for price appreciation. With an implied analyst target price of $118.11 per unit, this ETF suggests significant growth ahead.

Current Trading vs. Target Price

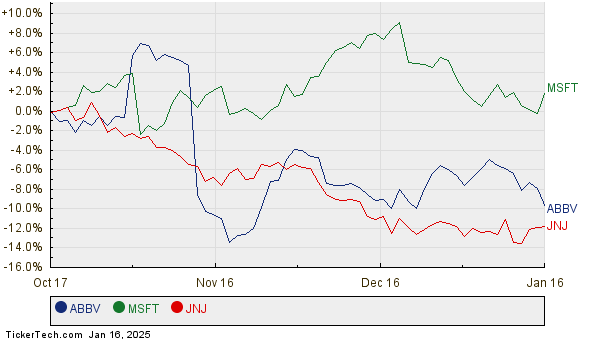

Currently priced at approximately $103.21 per unit, EQWL could see a 14.43% increase based on the predictions from analysts regarding its underlying assets. Key contributors to this optimistic outlook include AbbVie Inc (Symbol: ABBV), Microsoft Corporation (Symbol: MSFT), and Johnson & Johnson (Symbol: JNJ). For instance, AbbVie’s recent trading price of $171.35 per share has an average analyst target of $205.48, indicating a potential upside of 19.92%. Similarly, Microsoft’s current price of $426.31 could rise to a target of $510.26, reflecting a 19.69% increase. Analysts expect Johnson & Johnson will go up to a target price of $173.27 from a recent price of $144.97, showing a 19.52% upside. Below is the price performance chart for ABBV, MSFT, and JNJ over the past twelve months:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P 100 Equal Weight ETF | EQWL | $103.21 | $118.11 | 14.43% |

| AbbVie Inc | ABBV | $171.35 | $205.48 | 19.92% |

| Microsoft Corporation | MSFT | $426.31 | $510.26 | 19.69% |

| Johnson & Johnson | JNJ | $144.97 | $173.27 | 19.52% |

Analyzing Analyst Optimism

As investors consider these analyst targets, questions arise about their validity. Are analysts too hopeful in their predictions, or do they have solid reasoning? A high target price can signal optimism but may also hint at future downgrades if it does not align with market realities. Investors should conduct thorough research to assess the accuracy of these projections.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• High-Yield Canadian Real Estate Stocks

• Institutional Holders of LTRE

• Institutional Holders of EZT

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.