The Estee Lauder Companies Inc. (EL) reported first-quarter fiscal 2026 results revealing a 3% increase in skin care sales to $1,575 million, driven by core brands La Mer and Estee Lauder and a recovery in Asia travel retail. This growth contrasts with previous declines and contributed to the company’s overall sales increase during the quarter.

Notably, Estee Lauder gained an 8% share in the U.S. prestige beauty market’s skin care segment, outperforming the overall category’s 6% growth. Skin care operating income surged 60% year over year, backed by higher sales and operational improvements. However, management noted ongoing challenges in global travel retail and subdued consumer sentiment in Mainland China, indicating potential obstacles in sustaining growth.

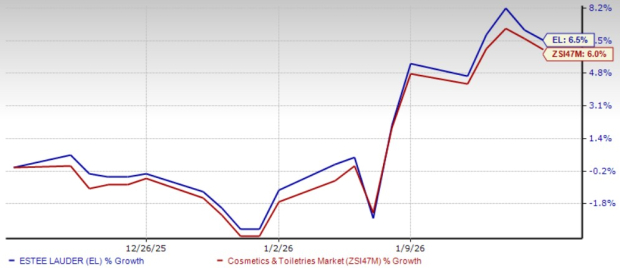

In comparison, Coty Inc. (COTY) faced declines in its Prestige segment amid efforts to realign retailer inventories, while e.l.f. Beauty, Inc. (ELF) is expanding its skin care offerings to capture the teen demographic, bolstered by acquisitions that enhance its product portfolio. Estee Lauder’s shares have increased by 6.5% in the past month, exceeding the industry’s 6% growth, although its forward price-to-earnings ratio stands at 44.45, above the industry average of 30.35.