Is Freeport-McMoRan a Smart Investment Amid Rising Copper Prices?

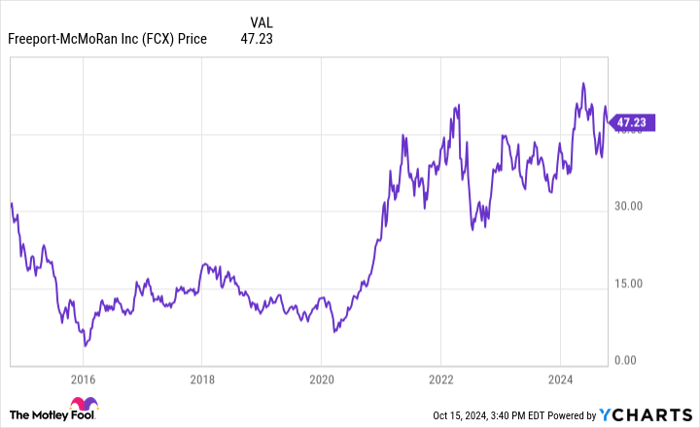

Shares of Freeport-McMoRan (NYSE: FCX) have experiencing a general rise since early 2020, mirroring the increase in copper prices. As one of the largest copper miners globally, this trend is crucial for investors considering whether to buy, sell, or hold Freeport-McMoRan. Let’s examine which option might suit your investment goals.

Reasons to Buy Freeport-McMoRan Stock

Copper is not a precious metal like gold or silver; it’s an industrial metal with numerous applications due to its excellent electrical conductivity and resistance to corrosion. Its malleability also allows it to be shaped easily, enhancing its utility.

Unlike gold, which also conducts electricity but at a much higher cost, copper plays a critical role in the growing demand for electricity across several industries, including transportation and aerospace. With companies like Tesla leading in electric vehicles and Archer Aviation nearing approval for battery-powered air taxis, the demand for copper is only expected to rise.

Image source: Getty Images.

Additionally, with increasing reliance on renewable energy sources like solar and wind, the demand for copper is expected to grow. NextEra Energy, for example, plans to nearly double its renewable capacity in the coming years.

The main argument for buying Freeport-McMoRan rests on the expectation that demand for copper will continue to rise. In fact, since hitting a low in 2020, copper prices have more than doubled.

Chairman Richard Adkerson and CEO Kathleen Quirk highlighted this potential in their second-quarter earnings statement: “The long-term outlook for copper is supported by copper’s increasingly important role in the global economy and limited available supplies to meet growing demand.” If you’re optimistic about copper prices, considering Freeport-McMoRan might be worthwhile.

Reasons to Hold Freeport-McMoRan Stock

However, there’s a significant concern: Freeport-McMoRan’s stock bottomed out alongside copper prices in March 2020. Since then, copper’s price more than doubled, resulting in a remarkable 750% rise in the company’s stock.

FCX data by YCharts.

With so much good news factored into Freeport-McMoRan’s stock price, investors might find themselves sitting on substantial gains. It’s crucial to have confidence that supply constraints will lead to higher prices. Otherwise, holding onto the stock could lead to anxiety.

Nonetheless, the dividend policy could motivate some investors to remain. With a yield of 1.2%, the payout structure is designed to reward shareholders when copper prices are high through a variable component added to a base payment. Therefore, investors aren’t solely dependent on price appreciation.

Reasons to Sell Freeport-McMoRan Stock

Yet, the positive outlook on copper comes with a downside. Commodities like copper are inherently volatile, influenced by factors such as supply and demand fluctuations or unexpected events like mine closures or regulatory interventions.

At the moment, sentiment suggests copper prices will continue to rise. However, following the significant price increase in recent years, this could change. If copper prices decline, Freeport-McMoRan shares are likely to follow suit. Investors who have seen substantial gains might want to secure some profits. If you entered the stock when it was at its lows, you could even remove your initial investment, leaving you with a position funded by your profits.

While selling will have tax implications, it might be prudent if you are concerned about a downturn in copper and Freeport-McMoRan’s stock price. In cases of heightened fear about volatility or risk, selling completely could be a wise move. If you’ve benefited from investing in Freeport-McMoRan but feel uncertain about the future, consider whether you should continue holding the stock.

Understanding Freeport-McMoRan’s Position

When examining Freeport-McMoRan, it’s essential to remember the foundation of their business: copper mining. While the business has merit, copper prices dictate the company’s performance and, consequently, its share price.

Believers in the copper story are likely to find Freeport-McMoRan a sound investment. Conversely, if you’re doubtful about copper’s future importance or price trajectory, it’s better to avoid this investment.

Is Freeport-McMoRan Worth $1,000 of Your Investment?

Before making any investment in Freeport-McMoRan, consider this:

The Motley Fool Stock Advisor analyst team recently identified their picks for the 10 best stocks to buy right now, and Freeport-McMoRan didn’t make the list. The recommended stocks are expected to yield impressive returns in the years ahead.

For example, consider that Nvidia was on this list back on April 15, 2005. If you invested $1,000 at that time, you would have approximately $831,707 today!

Stock Advisor offers investors a simple path to success, including tips on portfolio building, regular analyst updates, and two new stock picks every month. Since 2002, this service has more than quadrupled the S&P 500’s returns.

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends NextEra Energy and Tesla. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.