Is GitLab Stock Overvalued? A Closer Look at Its Performance and Prospects

GitLab (GTLB) shares are believed to be overvalued, highlighted by its poor Value Score of F.

Currently, GitLab’s forward 12-month price/sales (P/S) ratio stands at 15.69X, significantly above its median of 10.72X and the Zacks Computer and Technology sector’s average of 6.48X.

Analyzing the Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

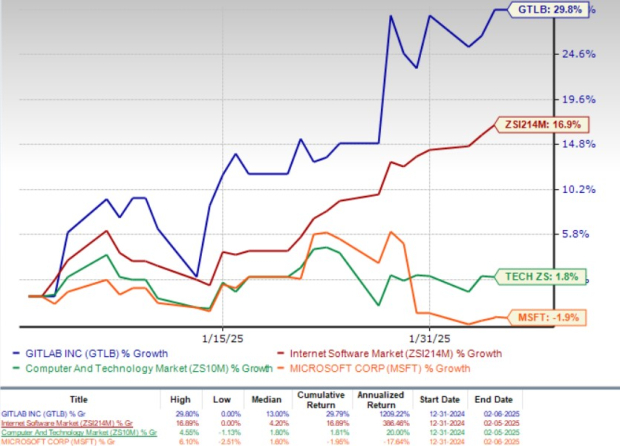

So far this year, GitLab’s shares have surged by 29.8%, greatly exceeding the broader sector’s rise of just 1.8% and the Zacks Internet – Software industry’s 16.9% increase.

The company’s success is driven by a growing customer base and robust adoption of its AI-enhanced DevSecOps platform. Notably, GitLab has outperformed Microsoft (MSFT), which has seen a 1.9% decline year to date.

Year-to-Date Performance Insights

Image Source: Zacks Investment Research

Additionally, GitLab is trading above both the 50-day and 200-day moving averages, suggesting a nourishing bullish trend.

Trading Above Moving Averages

Image Source: Zacks Investment Research

Yet, with such a high valuation, potential investors may ponder whether GTLB stock is a wise choice. Let’s explore further.

Strong Partnerships Fuel GitLab’s Growth

GitLab is leveraging a vast network of partners, including major cloud providers like Alphabet’s GOOGL Google Cloud and Amazon’s AMZN Amazon Web Services (“AWS”). These collaborations have been instrumental in expanding its reach among large enterprise clients.

In a recent initiative, GitLab teamed up with AWS to develop an AI-driven solution aimed at enhancing software development and security. This partnership merges GitLab Duo with Amazon Q’s advanced autonomous agents, streamlining workflows and accelerating code deployment while bolstering security throughout the software lifecycle.

Integrating GitLab’s DevSecOps platform with Google Cloud services is also boosting developer efficiency by simplifying authentication and improving application deployment processes.

GitLab’s Solid Revenue Projections for Q4 and Fiscal 2025

For the fourth quarter of fiscal 2025, GitLab anticipates revenues between $205 million and $206 million, marking a year-over-year growth of 25-26%. Non-GAAP earnings per share are projected to fall between 22 cents and 23 cents.

For the full fiscal 2025 year, revenue estimates range from $753 million to $754 million, implying a growth rate around 30% compared to the previous year. Expected Non-GAAP earnings per share are estimated to be between 63 cents and 64 cents.

Consistent Earnings Estimates for GTLB

According to Zacks Consensus, GTLB’s fourth-quarter fiscal 2025 revenue estimate is $205.64 million, indicating a robust year-over-year growth of 25.56%.

The consensus forecast for fourth-quarter earnings currently stands at 23 cents per share, remaining unchanged over the past 60 days and reflecting a year-over-year growth of 53.33%.

For fiscal 2025, the consensus estimate for revenues is at $753.46 million, implying a year-over-year growth of 29.93%.

The expected fiscal 2025 earnings are 63 cents per share, also steady over the last two months, indicating a remarkable year-over-year growth of 215%.

Notably, GitLab has consistently outperformed the Zacks Consensus Estimate for earnings in each of the last four quarters, with an average surprise of 89.06%.

GitLab Inc. Price and Consensus

GitLab Inc. price-consensus-chart | GitLab Inc. Quote

For the latest EPS estimates and surprises, visit Zacks Earnings Calendar.

Challenges Facing GitLab in the AI Arena

The accelerating progress in AI toward autonomous capabilities is posing a challenge for GitLab to continuously update its platform. Lagging in AI innovations could threaten its standing in a market that is becoming increasingly competitive.

Furthermore, the emergence of DeepSeek Coder, a rising Chinese competitor to GitLab Duo, emphasizes the urgency for GitLab to distinguish itself to retain its market share.

Evaluating GTLB Stock: Buy, Sell, or Hold?

With GitLab’s robust growth, innovative AI-powered DevSecOps platform, and strong partnerships, it has positioned itself as a leader in the DevOps market. Nonetheless, mounting competition and potential short-term profitability challenges could prove problematic.

Considering the stretched valuation and modest growth outlook, some investors may find the stock to be a risky investment.

GitLab’s Growth Score of F indicates it may not be appealing for those seeking growth opportunities.

Currently, GTLB holds a Zacks Rank #3 (Hold), suggesting that investors might be better off waiting for a more advantageous entry point. You can find the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

7 Top Stock Picks for the Coming Month

Recently released: Experts have identified 7 top-notch stocks from a pool of 220 Zacks Rank #1 Strong Buys, predicted to see significant price increases soon.

Since 1988, this comprehensive list has outperformed the market, boasting an average annual gain of +24.3%. Be sure to check these handpicked 7 stocks without delay.

Want the latest recommendations from Zacks Investment Research? You can download the 7 Best Stocks for the Next 30 Days report for free.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

GitLab Inc. (GTLB): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.