On August 19 and 20, Home Depot (HD) and Lowe’s (LOW) are set to report their Q2 earnings. Home Depot is projected to report a 5% increase in sales to $45.51 billion and a 1% rise in earnings per share (EPS) to $4.71. In comparison, Lowe’s expected sales increase is nearly 2% to $23.99 billion, with a 3% rise in EPS to $4.24.

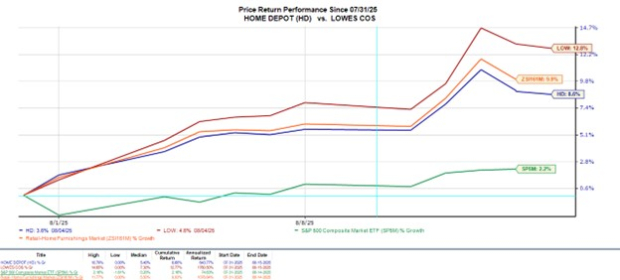

This year, both companies’ stocks have risen by over 2%, with Home Depot gaining over 8% this month and Lowe’s increasing by 13%. Lowe’s, reliant on imports, has faced tariff challenges, prompting CEO Marvin Ellison to focus on competitive pricing and supply chain diversification. Conversely, Home Depot benefits from sourcing over 50% of its products domestically.

In terms of valuation, Lowe’s trades at 20.5X forward earnings compared to Home Depot’s 26.6X. Home Depot offers a 2.3% dividend yield, while Lowe’s provides 1.9%, both exceeding industry averages. Both stocks currently hold a Zacks Rank of #3 (Hold) ahead of their earnings reports, which will be crucial in maintaining their market momentum.