Howmet Aerospace: What Analysts Are Saying About Its Stock Recommendations

Before deciding whether to buy, sell, or hold a stock, many investors look to Wall Street analysts for guidance. But how much weight should you give to their recommendations? Let’s dive into what analysts think about Howmet (HWM) and whether their insights are truly valuable.

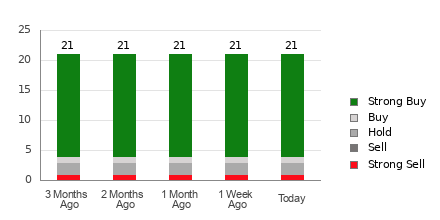

Currently, Howmet has an average brokerage recommendation (ABR) of 1.43, which ranges from 1 (Strong Buy) to 5 (Strong Sell). This rating is determined by the recommendations of 21 brokerage firms, with 17 issuing a Strong Buy and one giving a Buy. Together, these Strong Buy and Buy ratings compose 81% and 4.8% of all recommendations, respectively.

Understanding the Trends in Howmet’s Broker Recommendations

Explore the price target and stock forecast for Howmet here>>>

While the ABR suggests that investors should buy Howmet, it is important to approach this information cautiously. Research indicates that brokerage recommendations don’t always lead investors to stocks likely to appreciate in value.

Why is that the case? Brokerage firms often have a vested interest in the stocks they analyze, which can lead to biased ratings. For every “Strong Sell,” they typically assign five “Strong Buy” ratings, resulting in less insight into a stock’s future price movement for retail investors. Therefore, it is advisable to use the recommendations as a supplementary tool alongside your own analysis.

Our proprietary stock rating tool, the Zacks Rank, offers an externally verified method for predicting short-term price performance. The Zacks Rank classifies stocks from #1 (Strong Buy) to #5 (Strong Sell), providing a strong framework for making investment decisions based on earnings estimate revisions.

Distinguishing Between Zacks Rank and ABR

Although both the Zacks Rank and ABR use a scale of 1 to 5, they measure different factors. The ABR reflects the opinions of brokerage analysts and often includes decimals (such as 1.28). In contrast, the Zacks Rank is a quantitative model focused on earnings estimates, represented in whole numbers.

Brokerage analysts have historically been overly optimistic in their recommendations. Their ratings tend to be more favorable than warranted, largely due to the interests of their firms. This can mislead investors rather than guide them effectively.

On the other hand, the Zacks Rank is based on actual earnings estimate revisions, a metric that has shown a strong connection to near-term stock price movements. Its balance maintains a proportional representation across all stocks analyzed.

Additionally, ABR ratings may not always be current. In contrast, earnings revisions in the Zacks Rank reflect up-to-date trends in business, making it timely for predicting future stock prices.

Is Now the Right Time to Invest in HWM?

Recent earnings estimate revisions for Howmet show a 0.2% decline in the Zacks Consensus Estimate for the current year, now at $2.67.

This downward trend, coupled with a general consensus among analysts to lower their earnings per share predictions, could lead to a dip in the stock price soon.

The change in the consensus estimate, along with three other earnings-related factors, has assigned Howmet a Zacks Rank of #4 (Sell). You can find the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Consequently, it might be wise to view Howmet’s Buy-equivalent ABR with some skepticism.

Research Chief Names “Single Best Pick to Double”

Among thousands of stocks, five Zacks experts have selected their top picks, each expected to potentially rise +100% or more in the coming months. Among these, Director of Research Sheraz Mian has identified one stock with explosive potential.

This company caters to millennial and Gen Z consumers, having generated nearly $1 billion in revenue last quarter. With its recent pullback, now may be a strategic time to invest. While not every elite selection leads to success, this stock could outperform earlier Zacks recommendations like Nano-X Imaging, which surged +129.6% in less than 9 months.

Free: Discover Our Top Stock and 4 Runners-Up

Howmet Aerospace Inc. (HWM): Free Stock Analysis Report

Read this article on Zacks.com here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.