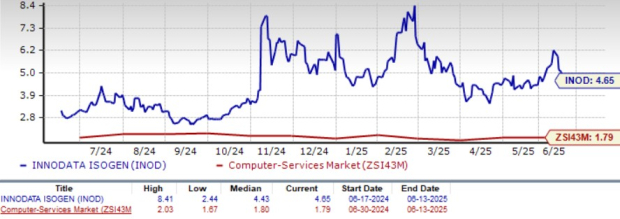

Innodata Inc. (INOD) shares are trading at a forward 12-month Price/Sales ratio of 4.65X, significantly higher than the Computer Services industry’s 1.79X. Notably, peer firms such as Broadridge Financial (3.88X), CSG Systems International (1.54X), and EXL Service (3.55X) are trading at lower multiples.

As of now, Innodata shares have dipped by 0.8% year to date, underperforming the industry’s return of 1.4% and the Computer & Technology sector’s 1.1%. Major competitors saw increases, with Broadridge Financial, CSG Systems International, and EXL Service rising by 4.9%, 23.4%, and 6.5%, respectively.

The Zacks Consensus Estimate for INOD’s second-quarter 2025 earnings is 11 cents per share, reflecting a 39% downward revision over the past 60 days. The company is investing $2 billion in AI technology to support current and prospective customers. However, anticipated revenue declines of 5% from its largest customer and targeted adjusted gross margins of 40% indicate potential challenges ahead.