“`html

Intel Corporation (INTC) is expanding its manufacturing capacity as part of its Integrated Device Manufacturing (IDM 2.0) strategy, with new products set to launch. The Intel Core Ultra series 3 processor (Panther Lake) will be available from January 2025, while the Xeon 6+ (Clearwater Forest) is slated for release in mid-2026. These products will be manufactured in a new factory in Chandler, AZ. Intel received $7.86 billion in funding from the U.S. Department of Commerce for semiconductor projects under the CHIPS Act, alongside investments from NVIDIA Corporation ($5 billion) and Softbank ($2 billion).

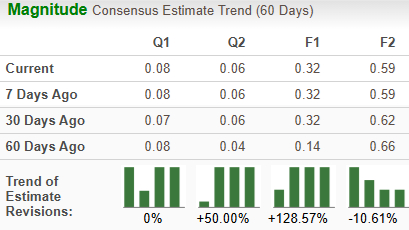

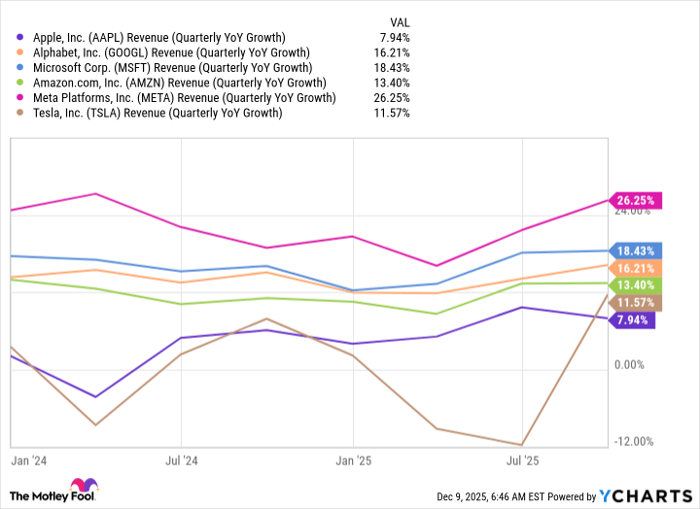

Pinterest, Inc. (PINS) aims to enhance its advertising platform and user experience by improving operational rigor and incorporating AI. The company’s 2025 sales are projected to grow by 16.1% year-over-year, with EPS expected to increase by 25.6%. However, Pinterest anticipates a significant rise in operating expenses as it expands. In comparison, Intel’s 2025 sales may decline by 1.3%, but its EPS is estimated to grow by 346.2%. Over the past year, Intel’s stock surged by 96.2%, while Pinterest’s declined by 9.9%.

Intel holds a Zacks Rank #3 (Hold), whereas Pinterest carries a Zacks Rank #4 (Sell). Despite anticipated revenue declines for Intel, its valuation metrics appear more attractive than those of Pinterest, which is experiencing growth in user engagement and expanding its ad capabilities.

“`