TSMC Reports Strong Growth Amid Trade Policy Concerns

Investor responses to Taiwan Semiconductor Manufacturing’s (NYSE: TSM) latest earnings report were mostly subdued. However, the company showcased robust revenue and profit growth once again. As the world’s leading semiconductor producer, TSMC is reaping significant benefits from the increasing demand for artificial intelligence (AI) infrastructure.

This article delves into TSMC’s financial results and future prospects, evaluating whether investors should consider buying the stock at this juncture.

An AI Leader with Trade Policy Challenges

There’s no denying that TSMC has emerged as a leader in AI technology. Its advanced capabilities and scale have made it a crucial player in the semiconductor value chain, partnering closely with top chip designers like Nvidia.

The company’s first-quarter results reflect this success, with a revenue increase of 35%, totaling $25.5 billion. Additionally, TSMC’s gross margin expanded by 190 basis points year-over-year, reaching 58.8%. This margin growth occurred despite an earthquake that affected its Kumamoto manufacturing facility in Japan during the quarter. TSMC’s long-standing pricing power has positively impacted its gross margin.

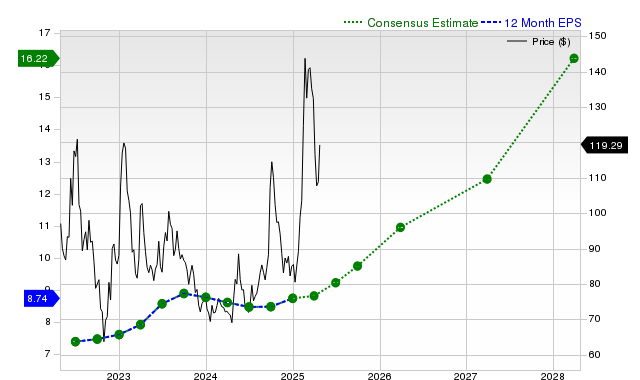

Profitability has also surged; earnings per American depositary receipt (ADR) rose 54% to $2.12 from $1.38 a year earlier, while net income in local currency increased by 60%. Both revenue and earnings exceeded analysts’ consensus estimates.

Nevertheless, some margin compression is anticipated in the upcoming quarters and coming years due to the expansion of overseas fabrication facilities, particularly in Arizona. The company forecasts a margin dilution of 2% to 3% for full-year 2025 as it ramps up its facilities in Kumamoto and Arizona.

AI chips remain the primary growth driver, with high-performance computing (HPC) comprising 59% of revenue for the quarter. This segment saw a sequential revenue increase of 7%. A year ago, HPC revenue made up just 46% of the company’s total revenue.

Smartphone chip sales, conversely, dipped 22% quarter-over-quarter due to seasonal trends, accounting for 28% of overall revenue compared to 38% the prior year. This shift towards AI chips signifies their growing impact on TSMC’s business model.

Moreover, more of TSMC’s revenue is aligning with advanced technologies. Nodes measuring 7 nanometers (nm) and below represented 73% of revenue, up from 65% the previous year. The latest 3nm technology contributed 22% of total wafer revenue, a significant climb from just 9% a year ago.

Looking ahead, TSMC has guided for second-quarter revenue estimates between $28.4 billion and $29.2 billion, implying approximately 35% year-over-year growth at the midpoint. Gross margins are expected to range from 57% to 59%, with operating margins between 47% and 49%.

The company has maintained its full-year revenue outlook, projecting an increase of nearly mid-20% levels. In the longer term, TSMC anticipates a 20% compound annual growth rate (CAGR) between 2024 and 2029 alongside a 53% gross margin.

Currently, TSMC has not observed any changes in customer behavior stemming from tariffs, maintaining strong AI-related demand. The company is also working on capacity expansion in coordination with customers, expecting AI revenue to grow at a mid-40s percentage CAGR over the next five years.

Image source: Getty Images.

Time to Consider TSMC Stock?

Despite concerns regarding tariffs and trade policy affecting semiconductors since previous administrations, TSMC continues to thrive with strong growth driven by AI chips. The company is advancing its U.S. manufacturing footprint to align with the needs of its leading customers.

As competitors face struggles, TSMC has secured its position as a key player in the advanced semiconductor arena. Although trade tensions pose uncertainties, the company is well-prepared for the future, particularly with the accelerating demand for AI infrastructure.

From a valuation perspective, TSMC’s stock appears attractive, trading at a forward price-to-earnings (P/E) ratio of 16 based on analysts’ estimates for 2025, and a price/earnings-to-growth (PEG) ratio of less than 0.5. Generally, stocks with PEG ratios below 1 are considered undervalued.

Thus, investors who can navigate short-term market fluctuations may find value in establishing positions in this strong company, as TSMC looks well-positioned for long-term success.

Evaluating a $1,000 Investment in TSMC

Before investing in Taiwan Semiconductor Manufacturing, consider the following:

Analysis from the Stock Advisor team has highlighted their recommendations for the 10 best stocks to buy now, and Taiwan Semiconductor Manufacturing is not among them. The stocks included in this analysis hold potential for substantial returns in the coming years.

For instance, Netflix was recommended on December 17, 2004. An investment of $1,000 at that time would now be worth approximately $566,035!* Similarly, Nvidia, recommended on April 15, 2005, would have turned a $1,000 investment into about $629,519!*

It’s important to note that the Stock Advisor platform has demonstrated an average return of 829%, significantly outperforming the S&P 500’s 155% return.

Explore the top 10 stocks here »

*Stock Advisor returns as of April 21, 2025.

Geoffrey Seiler holds no positions in the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.