“`html

IonQ, Inc. has achieved significant milestones in quantum computing, including a record performance of AQ 64 in algorithmic qubit performance and a 99.99% two-qubit gate fidelity. The company reported third-quarter revenues of $39.9 million, marking a 222% year-over-year increase, and raised its 2025 sales guidance to $110 million.

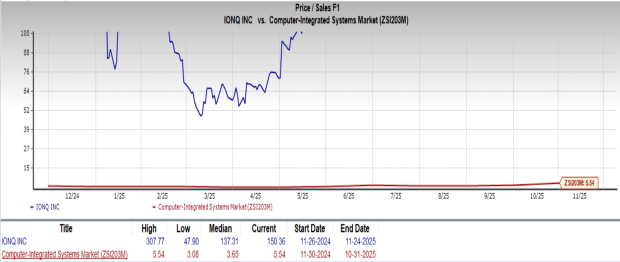

Despite its growth, IonQ reported a net loss of $1.1 billion for the same period, with adjusted earnings per share at -0.17. The company’s forward price-to-sales ratio stands at an alarming 150.36 compared to the industry average of 5.54.

IonQ recently acquired Vector Atomic and Oxford Ionics, enhancing its quantum platform. While the company is recognized for its advancements and partnerships, it is not yet profitable, raising concerns about its valuation in the current market climate.

“`