“`html

In September 2025, the U.S. Federal Reserve cut the federal funds rate by 25 basis points, marking its first rate reduction of the year and suggesting two more cuts before the year’s end. This monetary easing could enhance growth prospects for companies in the quantum computing sector, particularly IonQ (IONQ) and Quantum Computing Inc. (QUBT), as the Trump administration reportedly plans to accelerate federal adoption of quantum systems.

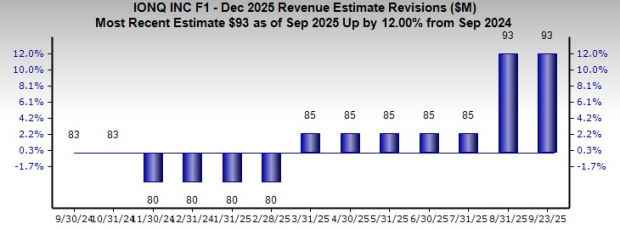

IonQ has seen a significant surge, with its shares jumping 94.3% in the past month, while QUBT gained 40.8%. IonQ’s strategic acquisitions, including Oxford Ionics and Vector Atomic, position it to achieve 40,000–80,000 logical qubits by 2030. QUBT, with a fully operational thin-film photonic chip foundry in Tempe, AZ, has made strides in securing orders for quantum systems and photonic chips, enhancing its commercial traction.

Despite the positive momentum, both companies face challenges. IonQ is grappling with high operational costs and the complexity of scaling its technology, while QUBT faces execution risks associated with integrating its products into existing markets. IonQ holds a Zacks Rank of #3 (Hold), indicating a more balanced risk profile compared to QUBT’s #4 (Sell), which suffers from high cash burn and limited revenue history.

“`