John Hancock Multifactor Large Cap ETF Analysts See Strong Upside Potential

At ETF Channel, we analyzed the underlying holdings of the ETFs in our coverage universe. By comparing the trading price of each holding against the average analyst 12-month forward target price, we calculated the weighted average implied target price for the John Hancock Multifactor Large Cap ETF (Symbol: JHML). The results indicate that the implied analyst target price for JHML is $81.80 per unit.

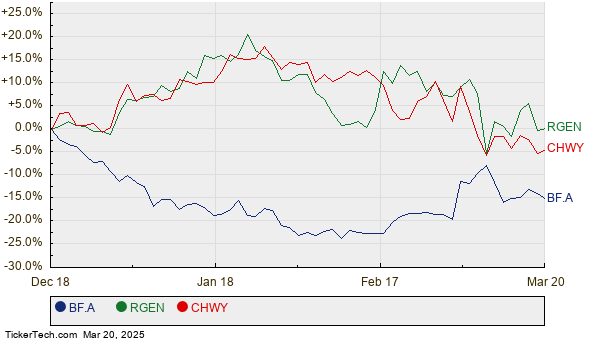

Currently trading at approximately $68.14 per unit, JHML shows a 20.04% potential upside based on analysts’ forecasts for the ETF’s underlying holdings. Notably, three holdings demonstrate significant upside potential relative to their analyst target prices: BROWN FORMAN CORP CLASS A (Symbol: BF.A), Repligen Corp. (Symbol: RGEN), and Chewy Inc. (Symbol: CHWY). Recently, BF.A traded at $34.35 per share, yet analysts project a price of $50.00 per share, suggesting a potential increase of 45.56%. Similarly, RGEN’s recent price of $144.88 suggests a 30.31% upside toward the average analyst target of $188.80 per share. For CHWY, the average target price is $38.88, reflecting a 20.54% gain over its recent price of $32.25.

Below is a twelve-month price history chart illustrating the stock performance of BF.A, RGEN, and CHWY:

We summarize the current analyst target prices discussed above in the table below:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| John Hancock Multifactor Large Cap ETF | JHML | $68.14 | $81.80 | 20.04% |

| BROWN FORMAN CORP CLASS A | BF.A | $34.35 | $50.00 | 45.56% |

| Repligen Corp. | RGEN | $144.88 | $188.80 | 30.31% |

| Chewy Inc | CHWY | $32.25 | $38.88 | 20.54% |

Are analysts justified in their target prices, or are they being overly optimistic about these stocks’ future performance? Investors should consider whether analysts have valid reasons for their targets or if they’re reactive to recent changes in company and industry dynamics. A high target price in relation to a stock’s trading price can indicate optimism for the future. However, it might also signal a risk of downgrades if these targets are outdated. Such considerations warrant additional research from investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

also see:

• Dividend History

• Institutional Holders of CNQR

• Funds Holding NXPI

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.