Analysts Predict Promising Upside for Invesco MSCI North America Climate ETF

Recent evaluations reveal that the Invesco MSCI North America Climate ETF (Symbol: KLMN) offers potential growth based on its underlying holdings.

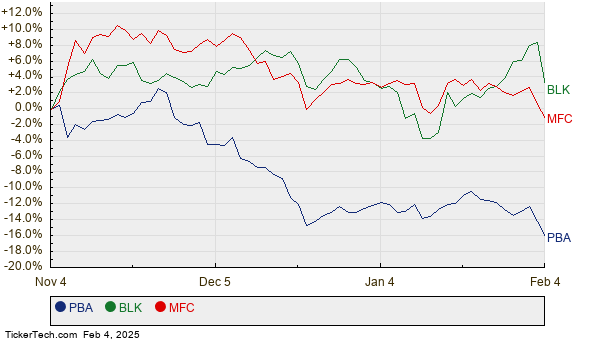

According to our analysis at ETF Channel, the calculated implied analyst target price for KLMN sits at $27.34 per unit. At its current trading price of approximately $24.32, analysts have identified a possible upside of 12.39% for the ETF. Key contributors to this outlook include Pembina Pipeline Corp (Symbol: PBA), BlackRock Inc (Symbol: BLK), and Manulife Financial Corp (Symbol: MFC). Specifically, PBA’s recent trading price of $35.13 per share trails its average target of $43.65 by 24.24%. BlackRock’s current value of $1013.75 suggests a 15.64% increase to reach its target of $1172.25. Similarly, MFC’s recent trading price of $29.30 indicates a 15.49% upside to the expected target of $33.84. Below is a price history chart reflecting the 12-month performance of PBA, BLK, and MFC:

A summary of the analyst target prices discussed above is listed below:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco MSCI North America Climate ETF | KLMN | $24.32 | $27.34 | 12.39% |

| Pembina Pipeline Corp | PBA | $35.13 | $43.65 | 24.24% |

| BlackRock Inc | BLK | $1013.75 | $1172.25 | 15.64% |

| Manulife Financial Corp | MFC | $29.30 | $33.84 | 15.49% |

Investors may wonder if these analyst targets are grounded in reality or if they reflect excessive optimism. Understanding the reasons behind these price targets is critical, especially in light of recent changes within the companies and their industries. While high targets can suggest confidence about future growth, they also risk prompting downward revisions if they fail to align with market developments.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Air Services Other Dividend Stocks

• TEP Options Chain

• PETX Price Target

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.