Analysts Predict Growth for SPDR S&P 400 Mid Cap Growth ETF

This ETF is eyeing promising returns based on projections from industry analysts.

Our analysis at ETF Channel examined the underlying holdings of the SPDR S&P 400 Mid Cap Growth ETF (Symbol: MDYG) and compared each holding’s trading price to the average analyst 12-month forward target price. The weighted average implied analyst target price for the ETF is $98.32 per unit.

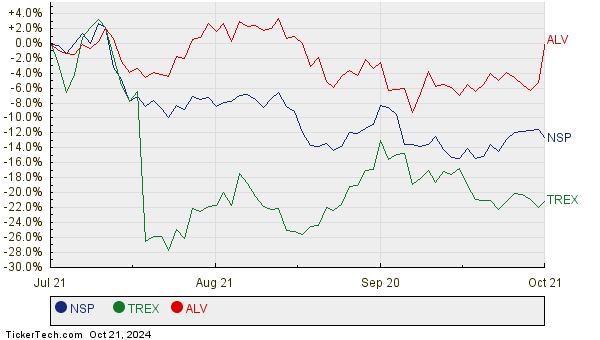

Currently, with MDYG priced around $89.66 per unit, analysts foresee a potential upside of 9.66%. Highlighted below are three underlying holdings of MDYG that show significant upside potential based on analyst forecasts: Insperity Inc (Symbol: NSP), Trex Co Inc (Symbol: TREX), and Autoliv Inc (Symbol: ALV). NSP is trading at $87.74 per share, but the average target is set at $109.67, suggesting a 24.99% increase. Similarly, TREX is priced at $64.62, with an average target of $80.40, indicating a potential upside of 24.42%. Analysts expect ALV to reach $123.69 per share, which is 24.28% higher than its recent price of $99.52. Below is a chart detailing the twelve-month price history of NSP, TREX, and ALV:

Here is a summary of the current analyst target prices for the mentioned companies:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR S&P 400 Mid Cap Growth ETF | MDYG | $89.66 | $98.32 | 9.66% |

| Insperity Inc | NSP | $87.74 | $109.67 | 24.99% |

| Trex Co Inc | TREX | $64.62 | $80.40 | 24.42% |

| Autoliv Inc | ALV | $99.52 | $123.69 | 24.28% |

Are these analyst targets reasonable, or could they be overly optimistic? Investors should consider whether analysts have sound reasoning backing these projections or if they might be out of touch with recent developments affecting these companies and their industries. High price targets compared to current trading prices might reflect optimism, but they can also lead to potential downgrades if those targets become outdated. Investors should conduct thorough research to make informed decisions.

![]() 10 ETFs With Most Upside to Analyst Targets »

10 ETFs With Most Upside to Analyst Targets »

Also see:

• AWH Split History

• MPET Historical Stock Prices

• SCHW Technical Analysis

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.