Meta and Snap Report Strong Q3 Earnings Amid Stock Reactions

On Wednesday, Meta Platforms META and Snap SNAP reported their third-quarter results, surpassing expectations for both revenues and profits. However, their stocks fell more than 3% during today’s trading session.

Snap’s shares initially rallied following its Q3 report, contrasting with Meta, which faced a selloff post-earnings on Thursday. The positive outlook for Snap was largely due to its Snapchat app doubling the number of active users and advertisers compared to last year, while Meta’s concerns centered around increasing expenditures.

Meta’s Impressive Q3 Performance

In the competitive world of social media, Meta reported daily active users (DAUs) increased to 3.32 billion for Q3, up from 3.19 billion a year ago.

The company’s Q3 sales reached $40.58 billion, exceeding estimates of $40.2 billion and reflecting a 19% increase from $34.14 billion in the same quarter last year. Furthermore, Meta’s earnings per share (EPS) of $6.03 surpassed the expected $5.19, marking a remarkable 37% rise from $4.39 a year prior.

Meta has consistently surpassed earnings expectations for eight quarters in a row, with an average EPS surprise of 11.34% over the last four quarters.

Image Source: Zacks Investment Research

CEO Mark Zuckerberg emphasized ongoing commitments to increasing investments in AI and the metaverse, which seemed to affect investor sentiment and prompted some profit-taking after earnings. Notably, META shares have gained nearly 60% in 2024 so far.

As for its financial position, Meta holds $43.85 billion in cash and equivalents, a rise from $41.86 billion at the end of Q3 2024, though this reflects a decrease from $65.4 billion at the start of the year.

Despite recent fluctuations, earnings estimates for both fiscal 2024 and 2025 have shown upward revisions. Currently, Meta’s stock holds a Zacks Rank #2 (Buy), with a projected EPS growth of 44% for FY24 and an anticipated increase of 13% in FY25, reaching $24.37 per share.

Image Source: Zacks Investment Research

Snap’s Strong Showing in Q3

Snap’s DAUs more than doubled year-over-year, reaching 443 million, with Q3 sales hitting $1.37 billion. This figure surpassed sales estimates of $1.35 billion and increased by 16% from $1.18 billion a year ago.

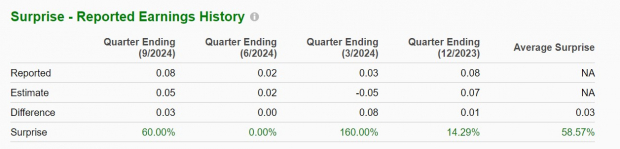

With an EPS of $0.08, Snap exceeded the Zacks Consensus estimate of $0.05 and showed growth from $0.02 a share in the previous year. Remarkably, Snap has met or topped the Zacks EPS Consensus for nine consecutive quarters, with an average earnings surprise of 58.57% over the past four quarters.

Image Source: Zacks Investment Research

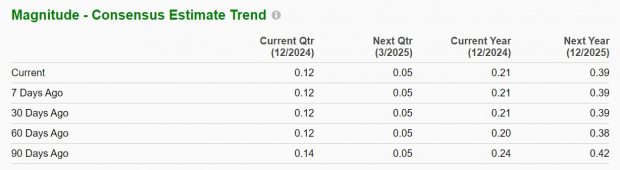

Despite these positive results, estimates for Snap’s earnings for FY24 and FY25 have declined over the past 90 days, resulting in a Zacks Rank #4 (Sell) for the stock. Snap shares are down 27% year-to-date, as the company continues to navigate profitability challenges since its IPO in 2017.

Image Source: Zacks Investment Research

Conclusion

The post-earnings decline in Meta’s stock may present a buying opportunity for long-term investors. Conversely, potential investors in Snap might want to exercise caution until earnings estimates begin to trend positively.

5 Stocks Positioned for Significant Growth

Discover top picks selected by a Zacks expert, each expected to gain +100% or more in 2024. While not every selection will succeed, past recommendations have soared by +143.0%, +175.9%, +498.3%, and +673.0%.

Many of the stocks included are currently under Wall Street’s radar, offering a unique chance to invest early.

Today, View These 5 Potential High Performers >>

Looking for the latest recommendations from Zacks Investment Research? You can download the report on 5 Stocks Set to Double for free.

Snap Inc. (SNAP): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.