Analyzing Wall Street’s Take on Meta Platforms: What Investors Need to Know

Before making decisions to buy, sell, or hold a stock, investors often check the recommendations of Wall Street analysts. While these ratings can influence a stock’s price, it’s important to consider their actual reliability.

Let’s dive into what analysts are saying about Meta Platforms (META).

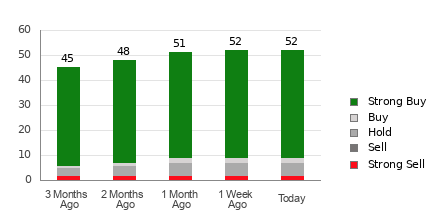

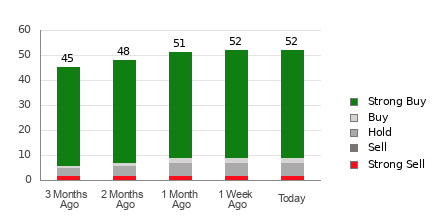

Currently, Meta Platforms holds an average brokerage recommendation (ABR) of 1.38, on a scale from 1 (Strong Buy) to 5 (Strong Sell), based on insights from 52 brokerage firms. This rating leans toward a Strong Buy, reflecting strong confidence in the stock.

Out of the 52 analyst recommendations, 43 are Strong Buy and only two are Buy, showing that 82.7% of the recommendations favor a Strong Buy while 3.9% suggest a Buy.

Understanding the Brokerage Recommendation Trends for META

For a complete overview of Meta Platforms’ price targets and stock forecasts, click here >>>

While the ABR indicates a favorable outlook for Meta Platforms, relying solely on this metric for investment decisions is not advisable. Research shows that brokerage recommendations do not consistently lead investors to stocks poised for significant price increases.

Why is this the case? Brokerage analysts, influenced by the interests of their firms, often exhibit a strong positive bias in their ratings. Our findings reveal that brokerage firms issue five “Strong Buy” recommendations for every “Strong Sell” recommendation.

This disparity means that the interests of brokerage institutions may not align with those of individual retail investors, providing limited insight into a stock’s potential price trajectory. Thus, it is wiser to use these recommendations as a supplement to your own analysis or alongside a proven tool for forecasting stock movements.

One reliable tool is our Zacks Rank. This system, which classifies stocks from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has a proven track record as a strong indicator of near-term stock performance. Pairing the Zacks Rank with the ABR can significantly enhance your investment decisions.

Distinguishing the Zacks Rank from ABR

Although both the Zacks Rank and ABR use a 1 to 5 scale, they measure different things. The ABR comes from analyst recommendations and is often shown with decimals (for example, 1.28). The Zacks Rank, however, is a quantitative model based on earnings estimate revisions and is displayed in whole numbers from 1 to 5.

Historically, brokerage analysts have tended to be overly optimistic in their assessments. Their suggestions often outpace what their research supports, leading to potential investor misguidance.

In contrast, the Zacks Rank utilizes earnings estimate revisions, offering solid empirical links between these revisions and subsequent stock price movements.

Moreover, the Zacks Rank applies across all stocks where brokers provide earnings estimates. This approach ensures that the rankings remain balanced among the five categories.

Another key difference between ABR and Zacks Rank is their timeliness. The ABR may lag behind current trends. Conversely, because brokerage analysts frequently update their earnings estimates in response to market changes, the Zacks Rank tends to react much faster, maintaining its reliability in predicting stock prices.

Should You Invest in META?

Recent earnings estimate revisions for Meta Platforms show that the Zacks Consensus Estimate for the current year has increased by 0.4% in the past month to $22.68.

This growing optimism among analysts regarding Meta’s earnings could signal strong potential for price gains in the near future. Along with this increase in consensus estimates, three other favorable factors have resulted in a Zacks Rank #2 (Buy) for Meta Platforms. For a complete list of today’s Zacks Rank #1 (Strong Buy) stocks, click here >>>>

Consequently, the Buy-equivalent ABR for Meta Platforms may act as a valuable guideline for investors.

Explore the 7 Best Stock Picks for the Next 30 Days

Recent insights reveal 7 high-grade stocks drawn from the current portfolio of Zacks Rank #1 Strong Buys. These stocks are identified as “Most Likely for Early Price Pops.”

Since 1988, stocks from this list have outperformed the market by over double, averaging a gain of +24.1% every year. Don’t miss out on these selected picks.

Want to keep up with the latest Zacks Investment Research recommendations? Download the report on 5 Stocks Set to Double now.

Meta Platforms, Inc. (META): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.