Analysts Recommend Microsoft Stock as Buy Amid Earnings Optimism

Wall Street analysts play a crucial role in guiding investors’ decisions on stocks. Media reports on changes in brokerage ratings often impact stock prices, raising questions about their reliability.

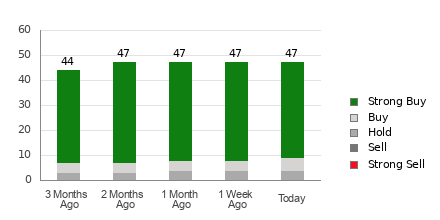

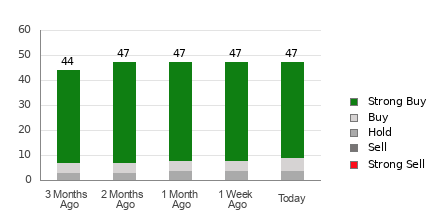

Currently, Microsoft (MSFT) has an average brokerage recommendation (ABR) of 1.28, based on 46 brokerage firms. This rating falls between Strong Buy and Buy, with 37 firms recommending Strong Buy and five recommending Buy. Together, these account for 80.4% and 10.9% of recommendations, respectively.

Current Trends in MSFT Brokerage Recommendations

While the current ABR suggests buying Microsoft, relying solely on this could be unwise. Studies indicate brokerage recommendations often fail to accurately guide investors to stocks likely to appreciate.

This bias arises because brokerage analysts may favorably rate stocks due to their firms’ interests. Research shows there are typically five “Strong Buy” ratings for every “Strong Sell.”

Consequently, these ratings might not reflect genuine market direction. They serve better as a tool for validating personal research or proven indicators of price movement.

The Zacks Rank, our proprietary tool reviewed externally, classifies stocks on a scale from 1 (Strong Buy) to 5 (Strong Sell) based on earnings estimate revisions. It stands as a reliable predictor of short-term stock performance and can complement ABR for informed decision-making.

Understanding Zacks Rank vs. ABR

Despite both measures using a 1 to 5 scale, Zacks Rank and ABR differ significantly. ABR is based solely on brokerage recommendations shown as decimals (e.g., 1.28). In contrast, Zacks Rank reflects earnings revisions and is shown in whole numbers.

Brokerage analysts historically display excessive optimism in their ratings, often leading to misleading recommendations. In contrast, Zacks Rank, rooted in earnings revisions, aligns more closely with near-term stock price movements.

Furthermore, Zacks Rank adapts quickly to changing earnings estimates, ensuring timely insights despite potential delays in ABR updates.

Should You Invest in MSFT?

For Microsoft, the Zacks Consensus Estimate for the current year rose 0.4% to $13.33 over the last month. This boost reflects analysts’ increasing optimism regarding earnings prospects, which may drive the stock price higher in the near term.

The Zacks Rank for Microsoft is currently #2 (Buy), attributed to the recent positive consensus estimate changes. A Buy-equivalent ABR could also guide investor decisions.

Market Insights: Stocks with High Potential

Our experts have identified five stocks with the potential for substantial growth, one of which is expected to significantly outperform others in the near future.

With a fast-growing customer base of over 50 million, this innovative firm is positioned for substantial gains. Although not every elite pick succeeds, historical examples show hidden potential, such as Nano-X Imaging, which rose by over 129.6% in less than nine months.

[For further insights, download the report on the top stocks for the next 30 days.]

This article is based on data from Zacks Investment Research.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.