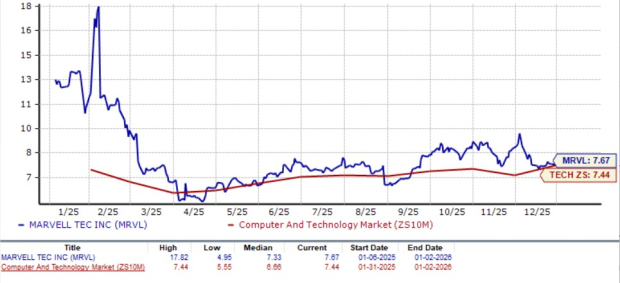

Marvell Technology (MRVL) is currently trading at a forward 12-month price-to-sales (P/S) ratio of 7.67, slightly above the sector average of 7.44. The company reported a significant revenue growth of 37.8% year over year, amounting to $1.52 billion in the third quarter of fiscal 2026, driven primarily by strong demand in custom silicon and interconnect products related to the AI boom.

Marvell expects its custom silicon business to contribute roughly 25% to overall data center revenues and anticipates a growth rate of at least 20% next year. The company recently acquired Celestial AI to enhance its offerings in the interconnect space and has made strategic partnerships with Amazon Web Services and NVIDIA to supply connectivity products for AI workloads.

Overall, the Zacks Consensus Estimates predict a 42% revenue growth and an 81% increase in earnings for MRVL in fiscal 2026, reflecting a positive outlook as the company expands its portfolio and maintains a competitive edge against giants like AMD and Broadcom.