Nebius Group Shares Rise Despite Recent Revenue Decline

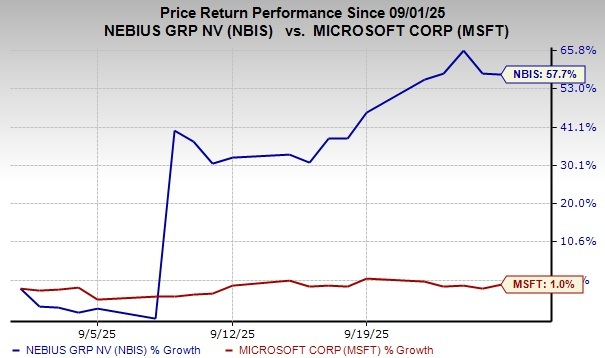

Nebius Group N.V. (NBIS) shares have surged more than 60.7% year to date, significantly outperforming the Zacks Computer & Technology sector, which has seen a decline of 0.9%, and the Zacks Internet Software and Services industry, which has appreciated by 8.8%. However, since February 20, following the release of fourth-quarter 2024 results, the company’s shares have experienced a 3.8% decline. This downturn can be attributed to lower Annual Recurring Revenue (ARR) in the December quarter, reported at $90 million, as NBIS focused efforts on expanding its sales and marketing teams and transitioning customers to its newly developed AI platform.

Performance Overview of NBIS Stocks

Despite the recent challenges, Nebius reported revenues of $37.9 million, a remarkable 466% year-over-year increase, driven primarily by its core AI infrastructure business, which saw a 602% year-over-year growth in the latest quarter. Looking ahead, the company anticipates an ARR of at least $220 million for the March quarter, with expectations ranging from $750 million to $1 billion for the full year 2025.

Image Source: Zacks Investment Research

The company’s positive outlook is supported by its strong liquidity position. In December 2024, Nebius raised $700 million in a private placement with investors, including NVIDIA (NVDA), Accel, and Orbis. By the end of the fourth quarter of 2024, the company held $2.4 billion in cash. From a technical standpoint, Nebius shares are currently trading above the 50-day moving average, indicating a bullish market sentiment.

Trading Above the 50-Day SMAs

Image Source: Zacks Investment Research

Future Prospects Driven by Expanding Offerings

Nebius’ main offering is an AI-centric cloud platform designed to handle demanding AI and machine learning tasks in both owned and colocation data centers. In addition, it offers several supplementary services, including Toloka (AI development platform), TripleTen (edtech service), and Avride (autonomous vehicle platform).

Notably, the company expanded its infrastructure in the fourth quarter of 2024 with the launch of its first U.S. NVIDIA GPU cluster based in Kansas City, with an initial capacity of 5MW. This facility is scheduled to go live at the end of the first quarter of 2025, housing thousands of NVIDIA Hopper GPUs and expandable to 40MW.

Furthermore, Nebius commenced operation of its GPU cluster in Paris, featuring NVIDIA H200 Tensor Core GPUs, during the reported quarter. By the end of the fourth quarter of 2024, the total number of deployed NVIDIA Hopper GPUs and H200 Tensor Core nearly doubled sequentially. The company plans to introduce over 22,000 NVIDIA Blackwell GPUs into data centers across the United States and Finland in 2025.

Built on NVIDIA’s accelerated computing platform, Nebius has launched The Nebius AI Cloud platform, which offers flexible, on-demand computing, high-performance storage, and managed services for AI-focused tasks. The Nebius AI Studio also underwent expansion, introducing support for vision models and new Large Language Models, including DeepSeek R1, in January 2025. Additionally, Tracto.ai, a serverless platform aimed at compute-intensive workloads, was recently released.

These advancements position the company favorably as the Total Addressable Market (TAM) for GPU-as-a-service and AI cloud services is forecast to grow at a CAGR of over 35% between 2023 and 2030. Moreover, the AI technology sector is projected to reach $800 billion by 2030, experiencing an average CAGR of 29% during the same period. Nebius’ other three business offerings collectively possess a TAM of approximately $150 billion.

Stable Earnings Estimates Amid Expected Revenue Decline

Currently, the Zacks Consensus Estimate for first-quarter 2025 forecasts a loss of 35 cents per share, unchanged in the past 30 days. The consensus revenue estimate for the same quarter is projected at $77.5 million, indicating an anticipated year-over-year decline of 96.88%.

Nebius Group N.V. Price and Consensus

Nebius Group N.V. price-consensus-chart | Nebius Group N.V. Quote

Assessment of NBIS Stock: Buy, Sell, or Hold?

Since resuming trading publicly on Nasdaq on October 21, 2024, Nebius’ stock is currently at a premium, reflected by a Value Score of D. While the company boasts a robust infrastructure, backed by partners like NVIDIA, growth prospects seem muted in the near term due to global macroeconomic challenges. Prolonged lead times as customers become more selective may hamper top-line growth. With significant investments in expanding capacity, margins are likely to remain pressured in the short run.

Nebius holds a Zacks Rank #3 (Hold), indicating that it may be prudent to await a more favorable entry point before purchasing the stock. For those interested, you can view the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set for Significant Growth

Each stock listed was carefully selected by a Zacks expert as a top candidate to gain +100% or more in 2024. While not all selections will succeed, prior recommendations have achieved incredible returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks in this report are flying under Wall Street’s radar, presenting excellent opportunities for initial investments. Today, explore these 5 potential high performers >>

For the latest recommendations from Zacks Investment Research, you can download the “7 Best Stocks for the Next 30 Days.” Click to access this free report.

NVIDIA Corporation (NVDA): Free Stock Analysis report

Nebius Group N.V. (NBIS): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.