“`html

Newmont Corporation (NEM) and Kinross Gold Corporation (KGC) are major players in the gold mining industry, currently benefitting from a surge in gold prices that have risen approximately 43% in 2025, reaching over $3,700 per ton. The increase is attributed to the Federal Reserve’s interest rate cuts and rising geopolitical tensions, alongside significant gold purchases by central banks.

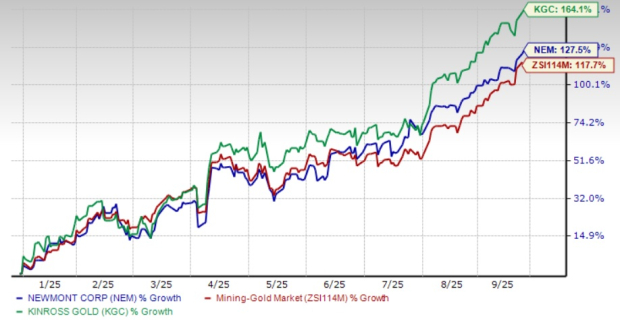

Newmont reported a robust liquidity of $10.2 billion, including $6.2 billion in cash, and generated a free cash flow of $1.7 billion in Q2 2025. In contrast, Kinross ended Q2 2025 with liquidity of roughly $2.8 billion and improved its net debt position to $100 million. NEM’s stock has increased by 127.5% year-to-date, while KGC’s has surged 164.1%, outperforming the Zacks Mining – Gold industry, which rose 117.7%.

Looking ahead, the Zacks Consensus Estimate predicts Newmont’s 2025 sales and EPS will grow by 10.7% and 57.5%, respectively, while Kinross is expected to see growth of 27.8% in sales and a substantial 108.8% in EPS. Investors currently rank Newmont as a Strong Buy (Zacks Rank #1) compared to Kinross, which holds a Hold rating (Zacks Rank #3).

“`