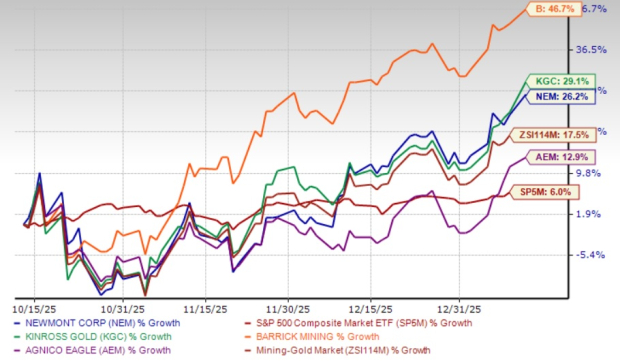

Newmont Corporation (NEM) shares have surged 26.2% over the past three months, driven by record gold prices surpassing $4,600 per ounce amidst geopolitical tensions and expectations of interest rate cuts. In comparison, the Zacks Mining – Gold industry saw a 17.5% rise, while the S&P 500 increased by 6%. Noteworthy, Newmont’s earnings forecast has topped analysts’ estimates, contributing to this rally.

Key Figures: NEM’s earnings estimates for 2025 are projected at $6.32, marking an 81.6% year-over-year increase, with 2026 estimates indicating a growth of 15.4%. The company has distributed over $5.7 billion to shareholders through dividends and buybacks in the last two years, positioning its dividend yield at 0.9% with a sustainable payout ratio of 17%.