Evaluating OneSpan: Are Analyst Ratings Reliable?

Wall Street analysts play a significant role in guiding investors’ decisions on stock transactions. Their ratings can lead to sharp price movements for stocks when they change. But how effective are these recommendations in reality?

Let’s assess the outlook for OneSpan (OSPN) before addressing the reliability of these brokerage opinions and how you might leverage them for better investment choices.

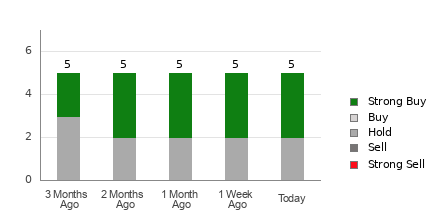

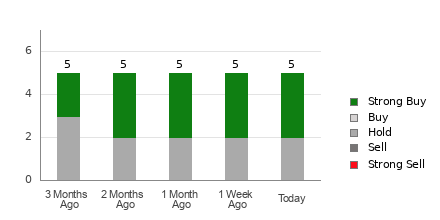

Currently, OneSpan holds an average brokerage recommendation (ABR) of 1.80, where a scale of 1 signifies a Strong Buy and 5 a Strong Sell. This average is drawn from the buy, hold, or sell suggestions given by five brokerage firms. The rating of 1.80 is between Strong Buy and Buy.

Out of these five recommendations, three are classified as Strong Buy, which accounts for 60% of the total endorsements.

Trends in Brokerage Recommendations for OSPN

View price target & stock forecast for OneSpan here>>>

While the ABR suggests a buy on OneSpan, relying solely on this metric for investment decisions would be unwise. Various studies indicate that brokerage recommendations often fail to help investors choose stocks with great potential for growth.

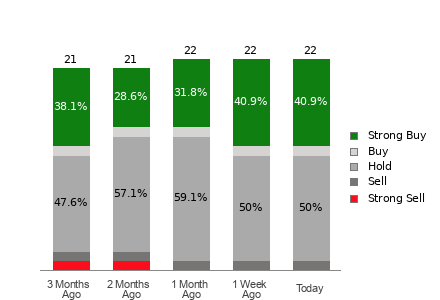

Why might this be the case? Analysts at brokerage firms often possess a bias due to their companies’ interests in the stocks they analyze. For every “Strong Sell” recommendation, these firms tend to issue five “Strong Buy” ratings. This discrepancy suggests that the motives of these institutions may not align with those of individual investors, offering little guidance on future price trends.

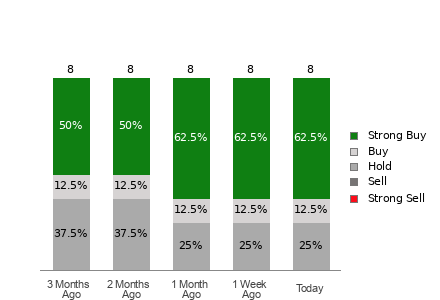

To make better choices, investors should consider using these recommendations alongside their own research or proven analytical tools. One such tool is the Zacks Rank, a proprietary stock rating system with a strong track record that categorizes stocks from Zacks Rank #1 (Strong Buy) to Rank #5 (Strong Sell). Utilizing the ABR in conjunction with the Zacks Rank can enhance decision-making when investing in stocks.

Differentiating Zacks Rank from ABR

Although both systems are represented on a scale from 1 to 5, they evaluate different criteria. The ABR arises solely from brokerage ratings and may feature decimal points (e.g., 1.28), while the Zacks Rank utilizes a quantitative model focusing on earnings estimate revisions and is displayed in whole numbers.

Given the tendency of analysts to display optimism in their recommendations, many may present ratings that exceed their research. The Zacks Rank, on the other hand, is grounded in earnings estimate revisions, which correlate closely with stock price movements over time.

Additionally, Zacks Rank maintains an equilibrium across all stocks for which analysts issue earning estimates, consistently applying all five ranks. Unlike the ABR, which may lag behind, the Zacks Rank quickly reflects analysts’ revised earnings estimates, making it a more timely indicator for predicting price trends.

Should You Consider Investing in OSPN?

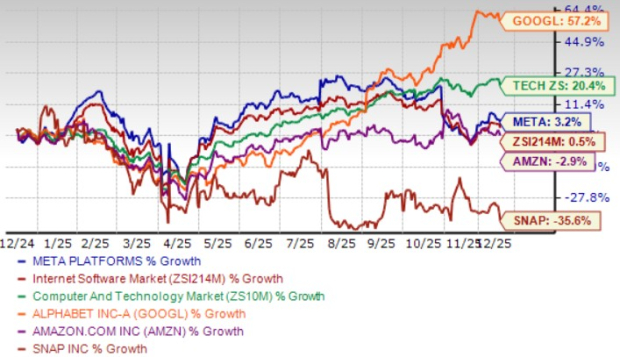

As for earnings estimate revisions for OneSpan, the Zacks Consensus Estimate has held steady at $1.34 over the past month. The stability in analysts’ earnings outlook might suggest that the stock could perform similarly to the overall market in the near future.

The unchanged consensus estimate, coupled with other related factors, led to a Zacks Rank #3 (Hold) for OneSpan. You can find the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>.

It may be wise to exercise caution with the Buy-equivalent ABR for OneSpan.

Experience Zacks Recommendations for Just $1

Yes, you read that right.

Years ago, we surprised our members by offering them 30-day access to our complete list of stock picks for only $1, with no obligation for further payments.

Thousands have taken advantage of this opportunity, while others hesitated, thinking it was too good to be true. We aim for you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which delivered numerous double- and triple-digit gains in 2023.

Get a Free Stock Analysis Report on ONESPAN INC (OSPN)

Read the full article on Zacks.com here.

The views and opinions expressed herein are the author’s own and do not necessarily reflect those of Nasdaq, Inc.