Palantir Technologies Soars Amid Major Developments and AI Growth

Palantir Technologies (NASDAQ: PLTR) has recently attracted attention with significant news. On November 4, 2024, the company shared impressive earnings for the third quarter. Later, on November 14, it revealed plans to move its stock listing from the New York Stock Exchange to the tech-focused Nasdaq Global Select Market, a transition that occurred on November 26. Furthermore, Palantir is optimistic about joining the Nasdaq-100, a shift that could draw more investors who track market indexes.

Stock Performance

Thanks to these developments, Wall Street has reacted positively, with Palantir’s stock soaring by 274% in 2024 as of now. After a stellar earnings report, the stock saw over a 50% increase, although it experienced a minor retreat due to profit-taking.

Analysts Caution Amid Optimism

Despite this surge, analysts are growing wary of Palantir’s soaring stock. According to data tracked by The Wall Street Journal, 24 analysts have set a median price target of $38 for Palantir stock, suggesting a potential decline of 41% from current levels.

The AIP Advantage

Palantir’s Artificial Intelligence Platform (AIP) aims to tackle real-time business challenges. AIP stands out by utilizing an “ontology,” which acts as a digital twin for organizations, mapping relationships between digital data and their physical counterparts. This platform has proven beneficial for numerous companies by enhancing productivity while cutting costs.

What sets AIP apart is its approach to market strategy. Rather than lengthy pilot projects, Palantir holds “boot camps” to showcase the practical uses of AIP using the client’s data. This strategy has allowed the company to onboard clients quickly—typically within two months—and encouraged them to expand existing contracts.

Growing Customer Base

Traditionally known for serving military and government agencies, Palantir is now making notable strides in the commercial sector. Its effective AI solutions have been central to this commercial growth.

In the third quarter, Palantir reported a 39% annual increase in its total commercial customer count, reaching 629 customers. Notably, the number of U.S. commercial customers surged by 77%, reaching 321.

Strength in Government Contracts

Palantir’s government business is thriving, propelled by a growing demand for AI solutions among government agencies. Revenue from this segment climbed 33% year over year to $408 million in the third quarter, with U.S. government revenue growing by 40% to $320 million. The U.S. Department of Defense has been a significant contributor to this growth, along with partnerships with defense contractors like L3Harris, Anduril, and Shield AI.

With the U.S. government business showing the fastest growth rate in 15 quarters, this could lead to a more diverse revenue stream for Palantir, particularly in national security and defense.

Financial Health

Palantir’s recent financial outcomes reflect its success. Revenue increased by 30% and surpassed the high end of the company’s forecast by 450 basis points. Additionally, the company reported a robust 58% adjusted operating margin and a 60% free cash flow margin, complemented by a strong balance sheet with $4.6 billion in cash and minimal debt—providing it with the flexibility to explore new projects.

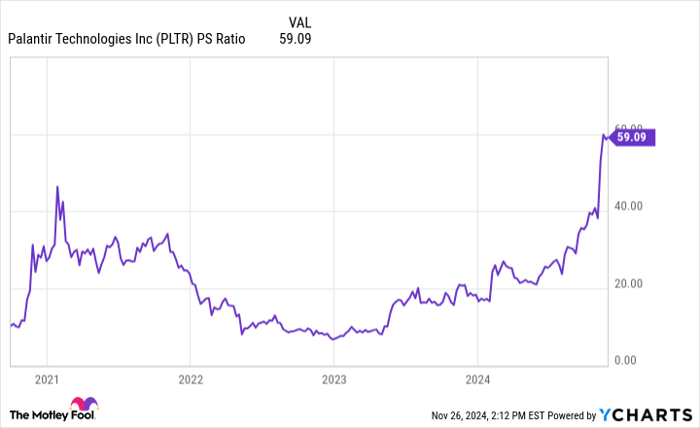

Valuation Concerns

Despite these positives, Palantir’s high valuation raises concerns. The company trades at a price-to-sales ratio near 60, which exceeds Nvidia‘s ratio of 31.

PLTR PS Ratio data by YCharts

While Palantir represents a compelling AI investment opportunity, its inflated valuation and execution challenges suggest that prudent investors should consider waiting for a price drop before seeking to invest.

Potential Future Opportunities

For those who worry they may have missed lucrative investment opportunities, there may be second chances ahead.

Occasionally, expert analysts recommend “Double Down” stocks—companies they believe are primed for significant growth. For example:

- Nvidia: A $1,000 investment in 2009 would be valued at $350,915 today!

- Apple: A $1,000 investment in 2008 would be worth $44,492 now!

- Netflix: A $1,000 investment in 2004 would have grown to $473,142.

At this moment, there are “Double Down” alerts on three remarkable companies, offering potential investors an exciting opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of November 25, 2024

Manali Pradhan has no positions in any of the stocks mentioned. The Motley Fool has positions in and recommends L3Harris Technologies, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.