Palantir Technologies Inc. (PLTR) reported a return on equity (ROE) of 27.6%, slightly below the industry average of 33.25%. The company focuses on long-cycle contracts and deep integration with customer workflows, necessitating significant upfront investments in engineering and infrastructure to foster long-term growth.

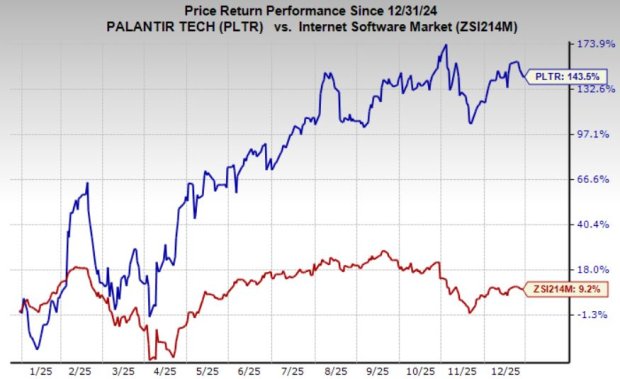

Over the past year, PLTR’s stock price surged by 143.5%, outpacing the industry average increase of 9%. Currently, it trades at a forward price-to-sales ratio of 70.5, significantly higher than the industry’s 4.8. The Zacks Consensus Estimate for PLTR’s earnings for 2025 has seen an upward revision in the last 60 days, and the company holds a Zacks Rank #2 (Buy).