“`html

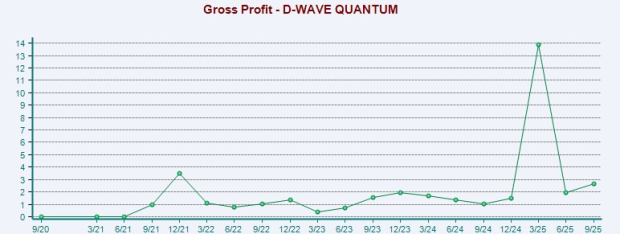

D-Wave Quantum (QBTS) reported a 100% year-over-year revenue increase for Q3 2025, with revenues rising to $2.4 million, surpassing the Zacks Consensus Estimate by 19.8%. GAAP gross profit rose 156%, while operating loss widened to $27.7 million, up from $20.6 million a year ago.

As of September 30, 2025, D-Wave held $836.2 million in cash and equivalents, a significant increase from $29.3 million a year prior. The company noted an 80% sequential increase in bookings, alongside contracts like a €10 million ($11 million) deal in Italy for its Advantage2 system, aimed at generating future revenue.

D-Wave’s shares have appreciated by 245.1% year-to-date, significantly outperforming industry peers. However, their current forward price/sales ratio stands at 250.58X, considerably higher than the sector average of 6.91X, raising concerns about overvaluation.

“`