Qualcomm Poised for Q4 Earnings Growth: What to Expect

Qualcomm Incorporated QCOM is set to announce its fourth-quarter fiscal 2024 earnings on November 6, 2024. The Zacks Consensus Estimate suggests revenues will reach $9.9 billion with earnings projected at $2.56 per share. Recent revisions show earnings forecasts for QCOM have increased, now expected at $10.08 per share for 2024 and $10.93 for 2025, up from $10.05 and $10.92, respectively, over the last 90 days.

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Recent Earnings Performance

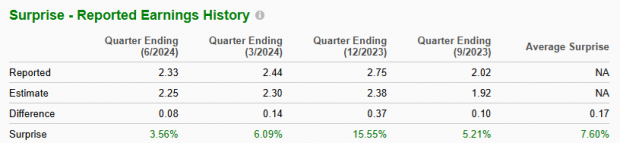

Qualcomm has maintained a strong earnings reputation, achieving an average surprise of 7.6% over the last four quarters. Notably, the most recent quarter saw a 3.6% positive earnings surprise.

Image Source: Zacks Investment Research

Forecasting Earnings Growth

Current analysis indicates Qualcomm is likely to exceed earnings expectations for the fiscal fourth quarter. The company’s positive Earnings ESP alongside a Zacks Rank of #2 (Buy) signals a strong possibility of an earnings beat. Qualcomm’s Earnings ESP sits at +0.48%.

Drivers Behind Expected Results

Qualcomm is witnessing growth from the rapid deployment of 5G technology, enhancing its licensing revenue. The firm is capitalizing on its robust 5G infrastructure and diversifying its income sources. With plans to integrate artificial intelligence (AI) into its offerings, Qualcomm aims to enhance user experiences in the digital economy, particularly through its Snapdragon product line.

In the recent fiscal quarter, Qualcomm demonstrated its technological advancements as Samsung integrated the Snapdragon 8 Gen 3 Mobile Platform into its latest Galaxy Z series smartphones, featuring enhanced gaming and improved AI photography capabilities.

The company is also partnering with Aramco to implement AI-driven IoT solutions in Saudi Arabia. These initiatives are expected to boost operational efficiency, improve equipment maintenance, and enhance safety protocols.

Stock Performance Overview

In the past year, Qualcomm shares have risen by 37.8%, although this growth lags behind the industry average of 51.1%. It has outperformed competitors like Hewlett Packard Enterprise Company HPE but has not kept pace with Broadcom Inc. AVGO.

Image Source: Zacks Investment Research

Valuation Insights

From a valuation perspective, Qualcomm’s stock appears relatively affordable, trading at a forward price-to-earnings ratio of 14.96. This is significantly lower than the industry average of 21.62 and the company’s own historical mean of 17.6.

Image Source: Zacks Investment Research

Investment Implications

As a leader in wireless chip technology, Qualcomm is committed to maintaining its 5G market dominance through innovative product launches and technological advancements. This focus is expected to facilitate seamless transitions to next-generation networks, driving widespread adoption among manufacturers.

Qualcomm stands out as the sole vendor offering comprehensive 5G solutions across various frequency bands and holds a significant share of the RF front-end market, with designs in numerous high-end smartphones.

Conclusion

With strong fundamentals and a promising outlook, Qualcomm emerges as a solid investment choice. Its competitive positioning, commitment to innovation, and positive earnings forecasts contribute to a favorable perception among investors. Given its history of earnings surprises, Qualcomm could deliver robust results in the upcoming quarter.

Research Chief Identifies Top Stock to Watch

A team of Zacks experts has selected five stocks with the potential to double in value in the upcoming months. The standout pick targets millennial and Gen Z demographics and has seen significant revenue growth, reaching nearly $1 billion last quarter. This recent dip in stock price presents a timely opportunity for investors. Some of Zacks’ prior recommendations, like Nano-X Imaging, have yielded returns exceeding +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

For the latest recommendations from Zacks Investment Research, you can download the report “5 Stocks Set to Double.” Click to access your free copy.

QUALCOMM Incorporated (QCOM): Free Stock Analysis Report

Broadcom Inc. (AVGO): Free Stock Analysis Report

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.