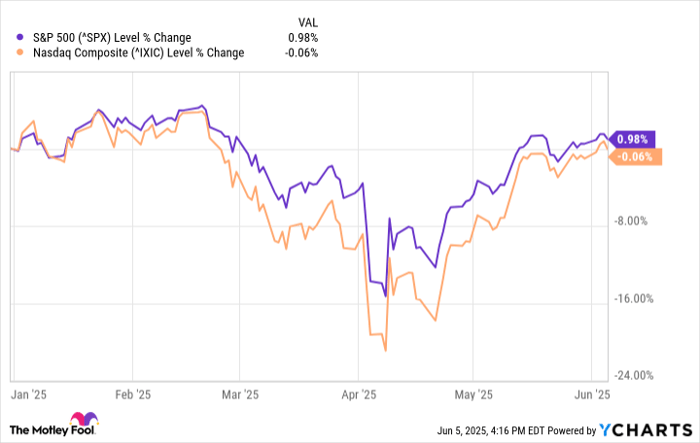

As of June 5, 2025, the S&P 500 and Nasdaq Composite have shown breakeven returns for the year, presenting challenges for investors. Amid this stagnant market environment, the “TACO” trade has emerged, which denotes a strategy of buying on dips when stock prices drop due to heightened volatility linked to tariff policies.

Key quantum computing stocks, IonQ (NYSE: IONQ) and Rigetti Computing (NASDAQ: RGTI), saw declines of 12% and 28%, respectively, in 2025 after impressive gains in 2024 of 237% and 1,450%. Despite these dips, their valuations remain high, with combined revenues of approximately $50 million but $460 million in net losses, suggesting they are not suitable “buy the dip” candidates at this time.

Overall, while the TACO trade reflects reactive buying strategies amidst market volatility, IonQ and Rigetti’s overvalued status amidst considerable losses raises caution for potential investors considering a renewed stake in these companies.