Is Rigetti Computing the Next Big Thing in Quantum Tech?

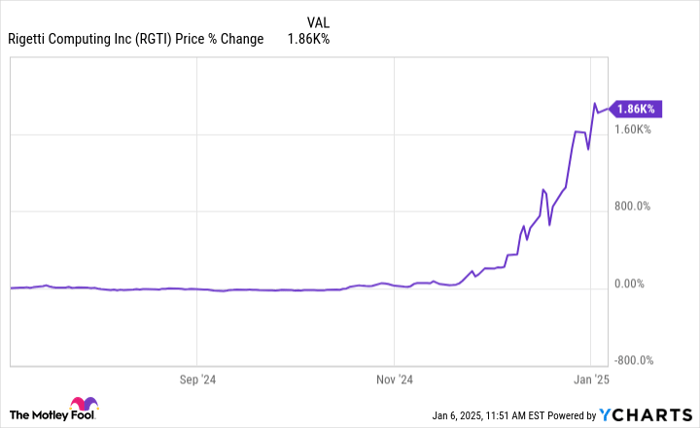

The quantum computing revolution is set to tackle complex problems once thought insurmountable, changing sectors like drug discovery and financial modeling. Among the companies in this emerging field, Rigetti Computing (NASDAQ: RGTI) stands out as a promising but speculative choice. Based in Berkeley, this quantum computer manufacturer has experienced its stock soar an incredible 1,860% in the last six months, reflecting a broader market enthusiasm for quantum technology.

Start Your Mornings Smarter! Get daily market news delivered right to your inbox. Sign Up For Free »

RGTI data by YCharts

As a leader in practical quantum computer development, Rigetti utilizes superconducting qubits, which function at extremely low temperatures and apply established semiconductor techniques. However, with a market cap of $5.33 billion and little revenue, investors must closely consider whether the stock’s current valuation makes sense.

Image source: Getty Images.

In this analysis, we’ll examine Rigetti’s technological strengths, financial condition, and market potential to assess if this soaring stock remains a worthwhile investment in 2025.

Technological Advancements Energize the Market

Rigetti’s cutting-edge 84-qubit Ankaa-3 system exemplifies its innovation. Achieving 99.5% median 2-qubit gate fidelity—a key performance indicator—this system’s success is attributed to a unique chip fabrication method called alternating-bias assisted annealing (ABAA), which ensures precise control over qubit frequencies.

Furthermore, Rigetti’s modular chip approach offers a strategic edge. Instead of relying on one large processor, the company connects smaller chips, achieving 99.4% fidelity in 9-qubit chips when linked together. Rigetti aims to develop a 36-qubit system with four interconnected chips by mid-2025, and anticipates a 100-plus qubit system later the same year.

Financial Standing Reinforced Amid High Valuation

The company’s financial outlook improved thanks to a $100 million capital raise last November, conducted through a direct offering of 50 million shares at $2.00 each to institutional investors. With $92.6 million in existing cash and investments, management feels equipped to advance its quantum computing plans without requiring further capital raises.

However, despite improved finances, Rigetti trades at an astonishing 260 times trailing sales—a valuation predicated on the belief that it will secure a significant market share as quantum computing develops. Although this transformative technology could create trillions in economic value, experts suggest that practical applications are still years away, likely emerging in the 2030s.

The competitive landscape adds further complexity. Tech giants like Alphabet and IBM have far greater resources in the quantum field, while a number of well-funded start-ups also compete for market leadership. Rigetti’s projected annual revenue is under $16 million this year, and it continues to face substantial losses, placing it at a disadvantage against these powerful rivals.

Strategic Partnerships May Boost Adoption

Rigetti’s partnerships lend support to its growth strategy. Major players like Amazon and Microsoft plan to offer the Ankaa-3 system via their cloud services, Amazon Braket and Azure, starting in the first quarter of 2025. This integration could broaden access to Rigetti’s technology and generate vital revenues for expansion.

Additionally, Rigetti collaborates with Riverlane on quantum error correction—a necessary step toward viable quantum computers. Their recent success in real-time, low-latency error correction on the Ankaa-2 system marks significant progress toward achieving fault-tolerant quantum technology.

Is Rigetti a Smart Investment?

Rigetti presents substantial technological innovations alongside a clear strategy for scaling its quantum platforms. The modular chip design and new fabrication methods suggest strong potential for creating more powerful systems. If these technologies advance as planned, partnerships with major cloud providers could facilitate faster commercialization.

The recent $100 million capital raise mitigates short-term funding risks. Yet, the current valuation implies high expectations with little room for delays. Investors must consider the revolutionary potential of quantum computing against real challenges, including technological hurdles, growing competition, and slower-than-expected adoption rates.

For those who believe in the future of quantum technology, Rigetti allows direct investment in a potential leader. However, due to its extravagant valuation and substantial risks, any investment should be considered speculative rather than foundational. The quantum computing evolution appears imminent, but selecting winners at this early stage demands careful deliberation and a robust risk strategy.

Should You Invest $1,000 in Rigetti Computing Now?

Before purchasing Rigetti stock, keep this in mind:

The Motley Fool Stock Advisor team has identified what they believe to be the 10 best stocks to buy now… and Rigetti Computing was not included in that list. The stocks highlighted could yield significant returns in the upcoming years.

Consider the example of Nvidia listed on April 15, 2005… if you invested $1,000 based on that recommendation, your investment would be worth $885,388!*

Stock Advisor offers an accessible strategy for investors, featuring guidance on portfolio building, regular analyst updates, and two new stock picks monthly. The Stock Advisor service has more than quadrupled the return of the S&P 500 since 2002.*

See the 10 stocks »

*Stock Advisor returns as of January 6, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. George Budwell has positions in Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Fool recommends International Business Machines and has specific options recommendations related to Microsoft. The Motley Fool maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily represent those of Nasdaq, Inc.