“`html

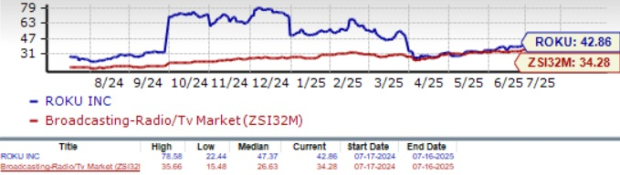

Roku’s stock is trading at a premium, with a price-to-cash flow ratio of 42.86X, exceeding the industry average of 34.28X. The company reported $310.1 million in operating cash flow for the trailing twelve months as of March 31, 2025, reflecting strong cash generation capabilities.

Roku is boosting subscriptions through new initiatives, including the acquisition of Frndly TV, which adds over 50 live and on-demand channels. In Q1 2025, they partnered with Apple TV+ to provide free trials and promotions. Roku also launched its first Roku-made TVs in Canada, enhancing user engagement and expanding its market reach.

Roku anticipates a loss of 18 cents per share for 2025, but total revenue is projected to be $4.55 billion, indicating a growth of 10.63% year-over-year. With shares rising 22.2% year-to-date but underperforming peers like Netflix and Disney, Roku’s strategic moves aim to solidify its position in the competitive ad-supported streaming space.

“`