“`html

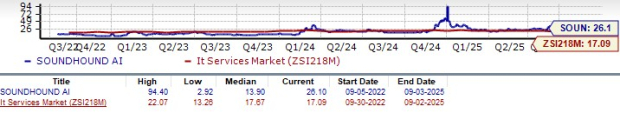

SoundHound AI (SOUN) is currently trading at a forward price-to-sales (P/S) multiple of 26.1X, significantly above its three-year median of 13.9X and the industry average. The company’s stock has seen a 34.6% rally over the past three months, outpacing its industry’s 8.7% decline. As of September 3, shares are priced at $12.74, nearly 195% above the 52-week low but 49% below the 52-week high.

In the second quarter of 2025, SoundHound reported revenues of $42.7 million, marking a 217% year-over-year increase and surpassing analyst expectations. Despite this growth, the company incurred a GAAP loss of $74.7 million, influenced by a $31 million non-cash expense. As of the end of Q2, SoundHound holds $230 million in cash with no debt, raising its 2025 revenue outlook to between $160 million and $178 million.

Even though SoundHound’s enterprise segment is expanding with increased demand and partnerships, ongoing operating expenses, such as R&D and marketing, are projected to limit profitability in the near term. The company may face volatility depending on deal timing and economic factors, including tariffs.

“`