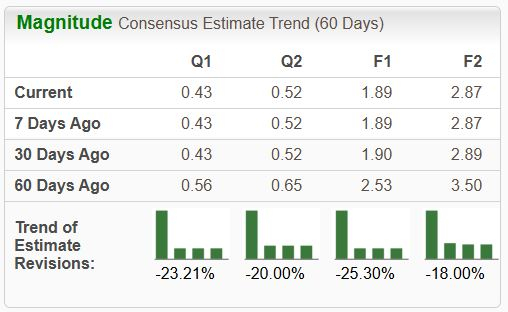

Tesla’s stock (TSLA) has experienced significant volatility in 2025, with shares down 30% overall. The company reported Q1 revenue of $19.3 billion and an adjusted EPS of $0.27, reflecting declines of 9% and 50% year-over-year, respectively. Analysts have downgraded Tesla’s outlook, resulting in a Zacks Rank #5 (Strong Sell).

In contrast, Rivian Automotive (RIVN) has gained 8% in 2025, posting a record gross profit of $206 million with vehicle production of 14.6k and deliveries of 8.6k units. Rivian’s FY25 delivery expectations have been revised down to a range of 40-60k vehicles.

Investors are advised to consider Rivian’s more favorable EPS outlook amidst Tesla’s ongoing challenges, as the latter’s gross margin has contracted to 16.3% from 17.4% last year.