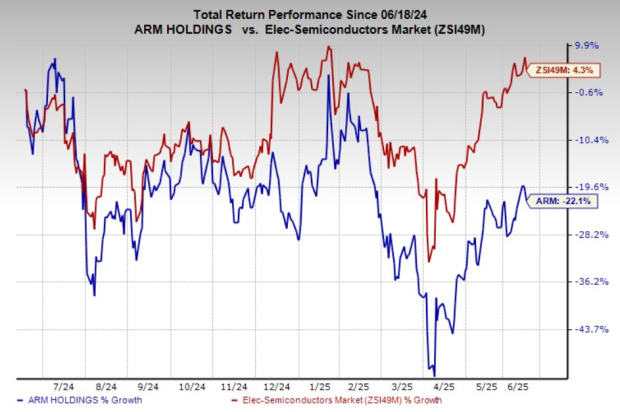

Arm Holdings plc (ARM) has seen a steep decline of 22% in its shares over the past year, contrasting sharply with the industry growth rate of 4.3%. This decline raises questions among investors regarding the right timing for potential investment.

Despite its leading position in power-efficient chip architecture essential for mobile devices, Arm Holdings faces challenges including sluggish growth in China, where it has significant market exposure. The rise of RISC-V architecture amongst Chinese firms, supported by government initiatives, threatens ARM’s market share in this region.

Analysts have recently revised ARM’s fiscal 2025 earnings estimates downward five times over the past two months, with the Zacks Consensus Estimate dropping by 15%. Moreover, ARM’s current valuation stands at approximately 73.36 times forward earnings per share, significantly above the industry average of 30.64 times, indicating potential overvaluation amid increasing investor skepticism.