“`html

Berkshire Hathaway (BRK.B) relies on its manufacturing operations, particularly in the industrial-products segment, for long-term growth, contributing approximately 46% to revenues and 50% to earnings. These operations encompass various industries, including aerospace and specialty chemicals, providing stable cash flows. Despite market fluctuations, the industrial-products sub-segment exhibits revenue and earnings improvement, backed by healthy margins.

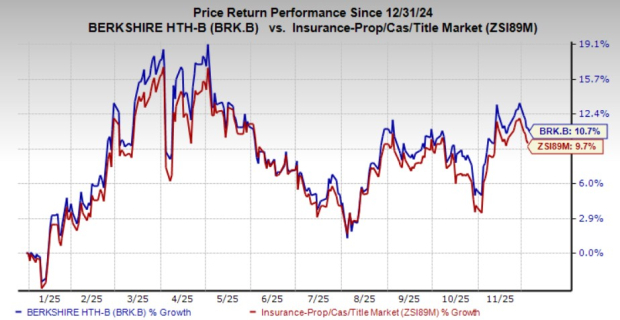

As of 2023, BRK.B shares have gained 10.7% year-to-date, outperforming the industry. The stock currently has a price-to-book ratio of 1.55, slightly above the industry average of 1.51. Additionally, Zacks’ consensus estimate shows a 15.8% decrease in EPS for Q4 2025 while a 12.3% increase for Q1 2026, indicating mixed future projections.

In comparison, competitors like 3M Company benefit from a strong demand for roofing granules and adhesives, while Honeywell International Inc. faces challenges due to industrial automation softness and high expenses despite its strong market position.

“`