“`html

Oracle Corporation (ORCL) has announced a significant increase in its capital expenditures, forecasting $35 billion for fiscal 2026, up from over $21 billion in fiscal 2025. This investment is aimed at expanding its cloud infrastructure and increasing its data center capacity, with plans to build 37 new multi-cloud data centers, bringing its total to 71 worldwide. The expansion comes in response to rising demand, with Oracle’s Remaining Performance Obligations projected to surpass $500 billion.

Oracle’s fiscal 2026 first-quarter results showed a negative free cash flow of $362 million, with forecasts expected to worsen to negative $380.7 million for the fiscal year. Meanwhile, Oracle’s Cloud Infrastructure (OCI) revenues are projected to grow 77% this year to $18 billion, targeting $144 billion by 2030. In comparison, Microsoft and Amazon also announced significant capital expenditures, with Microsoft planning over $30 billion for first-quarter fiscal 2026 and Amazon projecting over $118 billion annually, reinforcing their positions in the cloud and AI markets.

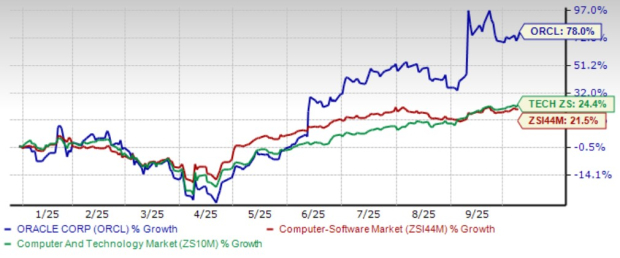

Oracle’s stock has seen a 78% increase year-to-date, outperforming its industry sector. However, its forward Price/Earnings ratio stands at 39.66x, above the industry average of 33.53x, suggesting overvaluation concerns. The Zacks Consensus Estimate for Oracle’s fiscal 2026 earnings is set at $6.76 per share, indicating a 12.11% growth from the previous year.

“`