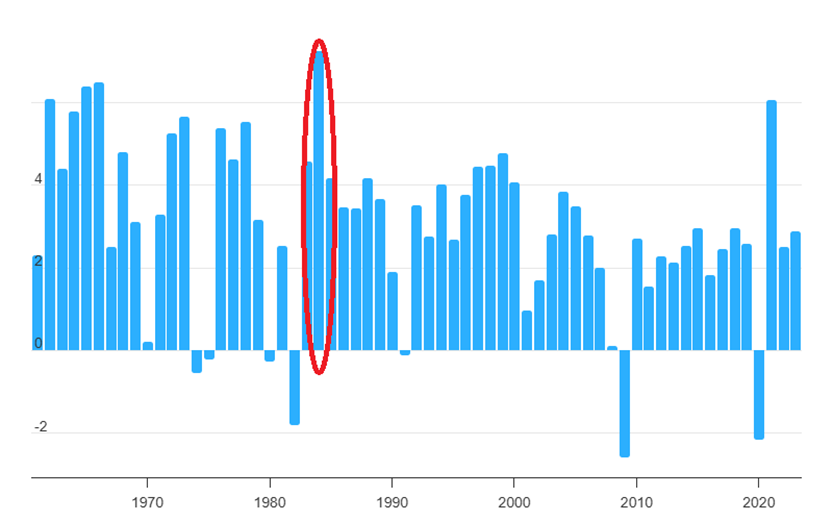

In 2024, the quantum computing sector is experiencing remarkable stock price increases, with D-Wave Quantum (NYSE: QBTS) leading the charge with a 474.9% surge year-to-date. This uptick comes amid broader optimism for the industry, as IonQ and Rigetti Computing also saw gains of 206% and 344.7%, respectively. D-Wave’s market capitalization stands at $1.2 billion, though it reported only $1.9 million in revenue for Q3 2024, a 27% decline from the previous year.

D-Wave specializes in quantum annealing technology for optimization challenges, securing partnerships with major organizations like NTT DOCOMO and Japan Tobacco Inc. Further, institutional interest is visible with companies such as Vanguard and BlackRock significantly increasing their stakes in D-Wave. Despite its strong stock performance, D-Wave’s financials reveal a widening quarterly net loss of $22.7 million, emphasizing the early stage of commercial quantum computing.

The global quantum computing market, valued at $885.4 million in 2023, is projected to grow to $12.6 billion by 2032, at a compound annual growth rate of 34.8%. However, analysts forecast that commercially viable quantum computers won’t appear until 2035-2040, raising questions about D-Wave’s rich valuation exceeding 93 times trailing sales, making it a high-risk investment option.