Rising Stars in Weight Loss: Eli Lilly’s Mounjaro and Financial Strength

While Novo Nordisk‘s (NYSE: NVO) Ozempic has dominated headlines in the weight-loss medication space, another drug is also gaining attention. Recently, Elon Musk showcased his weight loss in a Santa Claus suit on X, dubbing himself “Ozempic Santa,” but reports confirm he was actually using Eli Lilly‘s (NYSE: LLY) Mounjaro.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Given Eli Lilly’s impressive stock performance, investors are left wondering if now is the right time to buy. Let’s explore what the future holds.

Unpacking Eli Lilly’s GLP-1 Success

Despite Ozempic’s popularity, Eli Lilly’s Mounjaro and Zepbound have demonstrated greater effectiveness in clinical trials. Both drugs contain the same active substance, tirzepatide, but serve different purposes. Mounjaro is primarily approved for adults with type 2 diabetes, while Zepbound targets weight loss in obese adults, or adults with weight-related health issues.

Interestingly, non-obese individuals are increasingly using these medications for weight loss. A notable user is Elon Musk, who opted for Mounjaro, citing its effectiveness and fewer side effects compared to Ozempic, which he humorously suggested caused uncomfortable side effects for him.

A recent study found that Mounjaro significantly outperformed Ozempic. In a trial with 18,000 participants, those on Mounjaro were twice as likely to lose 5% of their weight and more than three times as likely to shed 15%. Specifically, patients on Mounjaro lost an average of 10% of their body weight after six months, compared to 6% for those on Ozempic.

Novo Nordisk has countered these findings, asserting the best dosage for weight loss with Ozempic was not disclosed. Nonetheless, Mounjaro’s popularity continues to rise, especially as it records impressive financial gains.

Strong Financial Performance

Eli Lilly’s GLP-1 drugs have significantly contributed to its financial success. Last quarter, Mounjaro’s revenue reached $3.11 billion, more than doubling from the previous year. Zepbound added $1.26 billion after its launch in Q4 2023.Overall, the company’s revenue increased by 20%, and its adjusted earnings per share soared from $0.10 to $1.18. Excluding a divestiture, revenue growth would have reached 42% year over year.

Looking ahead, Eli Lilly anticipates revenue growth of 50% in Q4, as it ramps up production and expands into international markets. The company has committed over $20 billion since 2020 to build and upgrade manufacturing facilities.

Image source: Getty Images.

Is Now the Time to Buy Eli Lilly Stock?

Eli Lilly’s portfolio extends beyond GLP-1 drugs, with non-incretin drugs also seeing a revenue increase of 17% last quarter. However, the weight-loss drugs are likely to play a key role in the company’s future performance and stock trajectory.

The company is well-positioned to meet the growing demand for its medications while entering new markets. Moreover, Zepbound has recently been approved for patients with obstructive sleep apnea, potentially expanding its target audience.

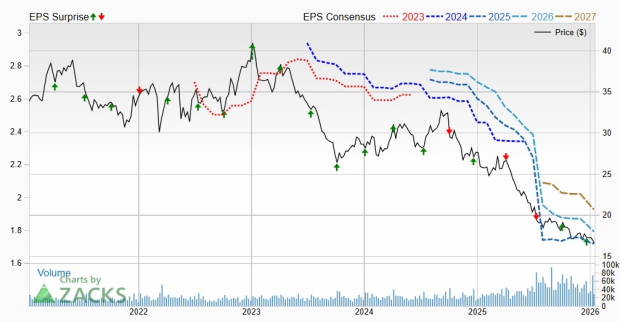

From a valuation standpoint, Eli Lilly’s stock trades at a forward price-to-earnings (P/E) ratio of 35 times next year’s estimates, with a price/earnings-to-growth (PEG) ratio of only 0.6, indicating it is attractively priced.

Data by YCharts.

Despite its successes, Eli Lilly faces challenges. Compounding pharmacies have been selling cheaper alternatives to GLP-1 drugs, and while Lilly’s drugs are no longer included in the shortage exemption list, competitors like Novo Nordisk still benefit from lower prices. Additionally, legal conflicts might arise as companies like Hims & Hers seek to create personalized medications that could compete with Eli Lilly’s offerings.

Furthermore, with Musk’s growing political influence and his calls for lower-priced medicines, Eli Lilly may encounter increased pressure on its drug prices.

In summary, while Eli Lilly’s stock presents a strong growth opportunity at an attractive valuation, investors should proceed with caution due to potential pricing pressures.

Is Investing $1,000 in Eli Lilly a Smart Move Now?

Before making an investment in Eli Lilly, it’s worth noting the Motley Fool Stock Advisor has spotlighted ten other stocks that currently offer great investment potential, excluding Eli Lilly from its recommended list. Consider the impressive returns seen with past picks like Nvidia, which would have turned a $1,000 investment in 2005 into $839,670 today.

Stock Advisor gives clear guidance for investors, assisting in portfolio building with updates and recommendations. The service has notably outperformed the S&P 500 since 2002.

See the 10 stocks »

*Stock Advisor returns as of December 23, 2024

Geoffrey Seiler has positions in Hims & Hers Health. The Motley Fool recommends Novo Nordisk. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.