IonQ’s Stock Fluctuates Amid Market Excitement for Quantum Computing

Quantum computing firm IonQ (NYSE: IONQ) has experienced a volatile period on Wall Street. After trading mostly sideways for the first three and a half years, IonQ’s shares surged from $6.22 in early September 2024 to a peak of $54.74 just three months later. However, by March 25, 2025, the stock had plummeted 53%, landing at $25.55 per share.

The question facing investors is whether IonQ is now a buy at these lower prices or if the previous gains were overinflated.

Looking to invest $1,000? Our analysts have identified the 10 best stocks to buy now. Learn More »

Let’s delve deeper into the situation.

Google’s Innovations Fueled IonQ’s Surge

The dramatic price increase seen last fall was not solely due to IonQ’s achievements. Instead, it was influenced by significant advancements made by rival company Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), which made notable progress in the quantum computing landscape. The introduction of the Willow chip added a revolutionary error correction function to Google’s technology platform, marking a vital milestone for the Quantum AI research group. This breakthrough followed a groundbreaking quantum calculation four years prior that surpassed what classic digital systems could achieve.

While this advancement is impressive, Google is still working toward developing a “large error-corrected quantum computer” capable of solving complex encryption issues and exploring DNA sequences innovatively. The most striking revelation in the Willow report was not just the error correction capability, but the fact that Willow could perform a basic quantum computing task in five minutes—something that would take 10 septillion years using today’s fastest digital supercomputers.

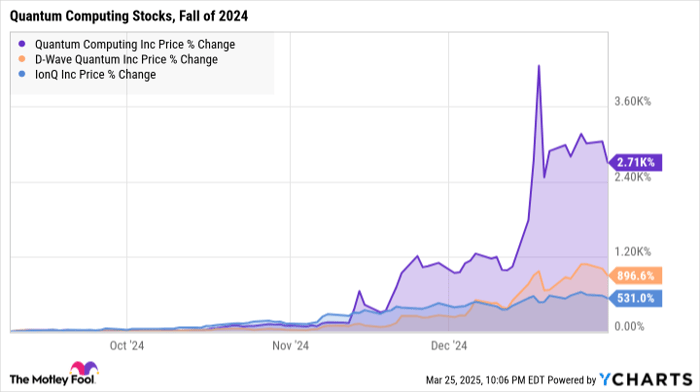

This highlighted Willow’s potential as a genuine quantum computer capable of completing benchmark tasks in a timely manner. The comparison to traditional supercomputers communicated the optimization of computing challenges for their specific machine type, yet it also fueled investor enthusiasm, driving up the stock prices of pure-play quantum computing firms like IonQ, which benefited immensely from this upward momentum. Smaller competitors such as D-Wave Quantum (NYSE: QBTS) and Quantum Computing (NASDAQ: QUBT) saw even greater increases.

QUBT data sourced from YCharts

Nvidia’s Warning Brings Market Reality Check

As the first quarter of 2025 progressed, the initial excitement waned when Nvidia (NASDAQ: NVDA)‘s CEO stated it may take up to 20 years to create a practical quantum computer. Nvidia is pioneering efforts to blend quantum computing with traditional digital systems, aiming to streamline the programming processes.

This declaration shifted investor sentiment, leading to renewed skepticism about the rapid advancements in quantum computing. Although there have been subsequent announcements of significant progress from other firms, skepticism remains—many claim these may just be marketing strategies rather than substantial breakthroughs.

The market for quantum computing stocks continues to navigate through a phase of high valuation amidst a cooling down period. While many pure-play companies await their next moves, their valuations remain inflated. For context, if Nvidia’s stock trades at a price-to-sales ratio of 22.6, consider the staggering valuations of emerging quantum firms:

|

Market Cap (Billions) |

Trailing Sales (Millions) |

Price-to-Sales Ratio |

|

|---|---|---|---|

|

Nvidia |

$2,945 |

$130,500 |

22.6 |

|

IonQ |

$5.69 |

$43.1 |

132 |

|

D-Wave Quantum |

$2.56 |

$8.8 |

290 |

|

Quantum Computing |

$1.16 |

$0.37 |

3,146 |

Data compiled from Finviz.com on March 25, 2025.

IonQ: A Less Risky Quantum Play Amidst Market Uncertainty

Determining long-term winners in the quantum computing arena is complex, especially among specialized companies lacking substantial market caps or extensive research budgets.

IonQ has the edge of a relatively extensive business history and has shipped several systems to clients. However, investing in such a company can feel akin to backing a speculative biotech firm developing a promising treatment with uncertain outcomes. An equal risk exists that many innovative projects may ultimately fail, leaving early investors with losses.

While it remains uncertain whether IonQ will experience such a fate, potential investors should be cautious. While IonQ stands out as the largest and relatively stable option among quantum specialists, it still may face significant risks. If you’re determined to invest in quantum computing, IonQ poses a more rational choice compared to smaller firms like D-Wave or Quantum Computing.

However, consider investing only what you can afford to lose, and explore established companies like Alphabet and Nvidia, which have proven their capabilities. The segment is currently filled with established technology giants.

Is Investing $1,000 in IonQ the Right Move?

Before making any purchases in IonQ, it is wise to reflect on the following:

The Motley Fool Stock Advisor has recently highlighted what they consider the 10 best stocks for investors, and IonQ was not among them. The stocks that were featured could offer substantial returns in the future.

When Nvidia made this list on April 15, 2005… if you had invested $1,000 based on our recommendation, it would be worth $697,245 today!

Stock Advisor provides investors with a comprehensive framework for success, including portfolio-building guidance, updates from analysts, and new Stock picks each month. The Stock Advisor has more than quadrupled the S&P 500’s return since 2002.* Don’t miss the latest top 10 list available upon joining Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of March 24, 2025.

Suzanne Frey, an executive at Alphabet, serves on The Motley Fool’s board. Anders Bylund holds positions in Alphabet and Nvidia. The Motley Fool recommends and has positions in Alphabet and Nvidia. For more details, please refer to The Motley Fool’s disclosure policy.

The views expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.