Understanding Netflix’s Analyst Ratings: Are They Worth Your Attention?

When investors are deciding whether to buy, sell, or hold a stock, they frequently turn to analyst recommendations. Although media reports on these rating changes can sway a stock’s price, their actual importance remains in question.

Let’s examine what analysts think about Netflix (NFLX) and evaluate the reliability of these recommendations to help you make informed choices.

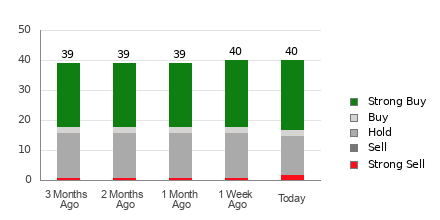

Netflix has an average brokerage recommendation (ABR) of 1.89, on a scale of 1 to 5 (ranging from Strong Buy to Strong Sell). This ABR is derived from the assessments made by 40 brokerage firms. An ABR of 1.89 suggests a rating between Strong Buy and Buy.

Out of the 40 recommendations that contribute to the ABR, 23 are Strong Buy and two are Buy. This means Strong Buy and Buy recommendations make up 57.5% and 5% of the total, respectively.

Current Trends in NFLX Ratings

For additional price targets and stock forecasts for Netflix, click here>>>

Even though the ABR suggests buying Netflix, it’s crucial not to base your investment decisions solely on this information. Research has shown that brokerage recommendations often fail to help investors select stocks with the greatest price increase potential.

Why might that be? Analysts working for brokerage firms usually have a vested interest in the stocks they cover, leading them to skew recommendations positively. According to studies, for every “Strong Sell” rating issued, there are about five “Strong Buy” recommendations.

This means that analysts may not align with the interests of individual investors, often obscuring actual stock price trajectories. Thus, using this information to support your own research might be more beneficial than relying on it as a standalone indicator.

Zacks Rank, a proprietary stock rating tool with a solid track record, categorizes stocks on a scale from #1 (Strong Buy) to #5 (Strong Sell) and serves as a valuable predictor of short-term stock performance. Pairing the ABR with Zacks Rank can offer a more effective investment strategy.

Distinguishing Zacks Rank from ABR

Although both Zacks Rank and ABR use a 1 to 5 scale, they measure different things.

The ABR relies solely on analysts’ recommendations, typically represented in decimals (for example, 1.28). In contrast, the Zacks Rank employs a quantitative model that focuses on revisions of earnings estimates and is displayed as whole numbers.

Analysts at brokerage firms often maintain overly optimistic ratings due to their employers’ interests. This results in more favorable ratings than their analysis might support, which frequently misleads investors.

On the other hand, the Zacks Rank is based on earnings estimate revisions. Empirical research indicates that short-term stock price movements closely correlate with these trends.

All stocks that brokerage analysts evaluate for current-year earnings estimates fall under the various Zacks Rank categories. This ensures that the ratings are distributed in a balanced manner.

Furthermore, the freshness of the information differs as well. The ABR can be outdated, while Zacks Rank quickly adapts to reflect changes in earnings estimates based on a company’s evolving business situation, making it a timely indicator of future price movements.

Should You Invest in NFLX?

The Zacks Consensus Estimate for Netflix’s earnings has increased by 0.1% in the last month, reaching $19.09.

Increasing optimism among analysts about the company’s earnings prospects suggests that there could be legitimate reasons for the stock to perform well shortly. The magnitude of the recent change in consensus estimates, along with other factors, contributes to Netflix receiving a Zacks Rank of #2 (Buy).

This Buy-equivalent ABR offers a potentially useful guideline for investors considering Netflix.

Explore Zacks’ Stock Picks for Just $1

Yes, you read that correctly.

Years ago, we surprised our members by offering 30-day access to all our stock picks for only $1, with no commitments.

While thousands took advantage of this offer, many others were skeptical, assuming there must be a catch. Our intent is simple: we want you to experience our portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and others, which this year alone yielded double- and triple-digit gains on 228 positions.

See Stocks Now >>

Want the latest insights from Zacks Investment Research? Download our report on 5 Stocks Set to Double for free.

Netflix, Inc. (NFLX): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.