Nvidia Stock Performance and Outlook

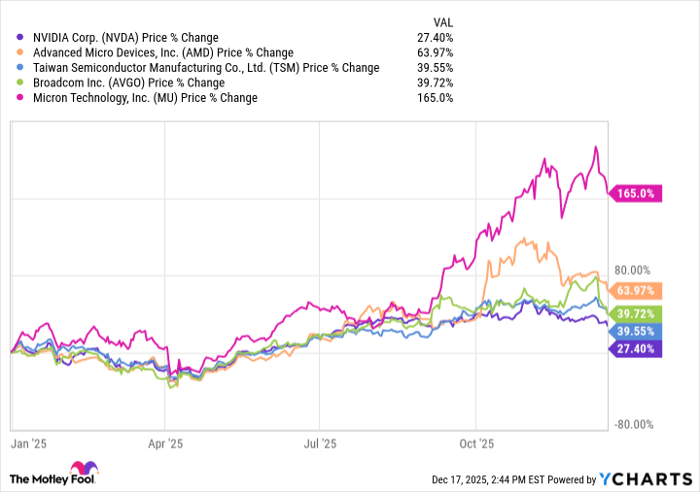

Nvidia’s stock (NASDAQ: NVDA) has underperformed compared to its peers in the semiconductor sector throughout 2025, despite the company’s historic operating performance. As of the latest fiscal quarter, December 2025, Nvidia’s price-to-sales (P/S) ratio stands at 23.3, down from 30.2 in the prior quarter, and its forward price-to-earnings (P/E) ratio is 23.4, also a decrease from 31.5. This valuation compression is attributed to increased competition and market uncertainty.

Going into 2026, Nvidia is bolstered by a substantial backlog of approximately $500 billion across key products, including the Blackwell and Rubin chips, with an estimated $300 billion expected to be recognized during that year. Major companies like Microsoft and Anthropic are also ramping up investments in AI infrastructure, projecting a total spend of around $500 billion in AI capital expenditures next year, indicating robust demand for Nvidia’s technology.

Despite rising competition from firms like AMD and Broadcom, industry analysts remain optimistic about Nvidia’s long-term prospects, suggesting it retains a significant position in the accelerating AI market, projected to be worth $7 trillion in the next five years.