SoundHound AI Faces Market Turmoil: Is This the Right Time to Invest?

SoundHound AI (NASDAQ: SOUN) is experiencing significant difficulties in 2025, with its shares plummeting over 57% as of February 25. The recent decline was triggered by news that semiconductor giant Nvidia has sold its stake in the company.

In February 2024, SoundHound gained attention when it was revealed that Nvidia held a small stake valued at $3.7 million. Following this announcement, SoundHound’s stock soared in the fourth quarter of 2024. However, Nvidia’s sale of its shares at a profit has now prompted many investors to panic.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

But could this latest downturn actually present a buying opportunity for this rapidly growing AI company? Let’s explore.

Nvidia’s Exit: A Small Concern for SoundHound

SoundHound’s market cap is currently just over $4 billion, making Nvidia’s stake too minor to justify such a sharp decline in stock price. Some investors might speculate that Nvidia’s departure indicates a lack of expected growth for SoundHound, particularly given its high valuation. Indeed, SoundHound has been trading at elevated levels in the past year.

Currently, the company trades at a price-to-sales ratio of 47, down from an earlier 90 at the end of 2024. This dip may offer investors a chance to acquire the stock at a more reasonable valuation, while the company’s growth rate could still support its share price.

So, should growth-oriented investors consider SoundHound now?

Promising Growth Ahead for SoundHound

SoundHound plans to announce its fourth-quarter 2024 results on February 27, with projections showing an 82% revenue increase in 2025 compared to the previous year. This follows a strong 47% revenue growth in 2023.

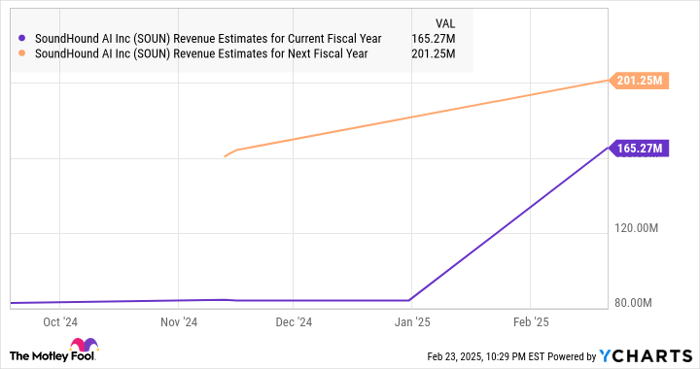

The midpoint of the company’s 2025 revenue guidance is estimated at $165 million, nearly doubling its 2024 revenue. However, analysts predict a slowdown in growth for 2026, as outlined in the chart below.

SOUN Revenue Estimates for Current Fiscal Year data by YCharts

Despite this outlook, SoundHound could surpass Wall Street’s expectations. The company reported a combined backlog of over $1 billion after acquiring enterprise AI software firm Amelia, which is significantly more than its projected revenue for 2024 and 2025.

Additionally, SoundHound is making waves in the market with its voice AI solutions, already attracting clients in the automotive and restaurant sectors. Its recent acquisition of Amelia could enhance its customer base and open new avenues for growth.

Recent integrations of SoundHound’s technology by companies like Lucid Motors and Kia illustrate the demand for its solutions. Furthermore, the voice AI market is expected to grow nearly 20-fold from 2024 to 2034, potentially reaching close to $48 billion in annual revenue in ten years.

Investors who are willing to shoulder some risk for SoundHound’s impressive growth may find themselves rewarded, especially if the company performs well in its upcoming earnings report.

It’s essential to keep in mind, however, that SoundHound’s stock has been known for its volatility, and its high valuation could lead to significant price fluctuations.

Is Now the Right Time to Invest in SoundHound AI?

For potential investors, important considerations include:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks to invest in right now—and SoundHound AI is not among them. The stocks that made this prestigious list could yield substantial returns in the coming years.

Consider that Nvidia was featured on April 15, 2005… if you invested $1,000 at that time, you’d have $776,055!*

Stock Advisor provides a straightforward approach to investing, complete with guidance for portfolio building, regular analyst updates, and two new stock recommendations monthly. The Stock Advisor service has more than quadrupled the returns of the S&P 500 since 2002*.

Learn more »

*Stock Advisor returns as of February 24, 2025

Harsh Chauhan has no positions in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.