Understanding Analyst Ratings: Insights on Toyota Motor Corporation

Investors frequently look to analyst recommendations when deciding to buy, sell, or hold stocks. While media reports on these rating changes from brokerage firms can sway a stock’s price, it’s essential to consider the real impact of these recommendations.

For instance, regarding Toyota Motor Corporation (TM), current analysis suggests an average brokerage recommendation (ABR) of 1.50, which is calculated on a scale from 1 to 5, where 1 indicates a Strong Buy and 5 indicates a Strong Sell. This ABR indicates a stance favoring a Buy, roughly between Strong Buy and Buy.

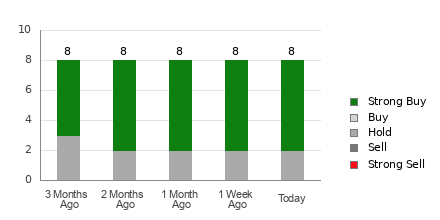

Toyota Motor: Current Brokerage Recommendations

A breakdown of the eight brokerage recommendations supporting this ABR reveals that six fall into the Strong Buy category, accounting for 75% of the total recommendations.

Check price target & stock forecast for Toyota Motor here>>>

Although the ABR leans towards buying Toyota Motor, relying solely on this data for investment decisions might not be advisable. Research has demonstrated that brokerage recommendations often do not succeed in guiding investors toward stocks with the best potential for appreciation.

This discrepancy largely stems from brokerage analysts’ vested interests in the stocks they cover. Our findings show that for every “Strong Sell” recommendation, there are about five “Strong Buy” recommendations among these analysts.

Given this tendency towards positive bias, the recommendations may not always align with actual market performance. Therefore, investors should consider these ratings as a tool to validate their research rather than the sole basis for their decisions.

Comparing Zacks Rank and ABR

A useful framework for investors is the Zacks Rank, which classifies stocks into five groups from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This ranking system is based on a strong track record supported by external audits and focuses on earnings estimate revisions to predict near-term price performance. Hence, aligning the Zacks Rank with ABR might increase your chances of making profitable investments.

While both Zacks Rank and ABR utilize a 1 to 5 scale, they operate differently. The ABR derives from brokerage recommendations and often appears in decimals, whereas the Zacks Rank uses whole numbers and emphasizes earnings revisions.

Notably, brokerage analysts tend to overestimate ratings due to their companies’ interests, often complicating accurate guidance for investors. Zacks Rank, however, draws upon earnings estimate trends—demonstrating that stock price movements correlate closely with these trends according to empirical research.

Furthermore, the Zacks Rank is dynamic and up-to-date. While ABR may lag behind current market insights, the quick responses of brokers to revisions allow the Zacks Rank to present timely, relevant performance indicators.

Investment Outlook for Toyota Motor

Currently, the Zacks Consensus Estimate for Toyota Motor’s earnings remains unchanged at $22.34 for the current year. This stable outlook in earnings expectations suggests the stock may perform consistently with the overall market moving forward.

Considering the analysis, Toyota Motor currently holds a Zacks Rank of #3 (Hold), primarily due to the steady nature of the earnings consensus estimate and its related factors. For further insights, you can explore a complete list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

In light of this information, investors might want to proceed with caution regarding the Buy-equivalent ABR for Toyota Motor.

5 Stocks Set to Double

Our team of experts has identified five stocks that they believe could gain +100% or more in 2024. While past performance does not guarantee future results, previous picks have seen returns of +143.0%, +175.9%, +498.3%, and +673.0%.

Many of these potential winners are currently under the radar of major Wall Street analysts, creating an opportunity for savvy investors.

Today, See These 5 Potential Home Runs >>

Toyota Motor Corporation (TM): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.