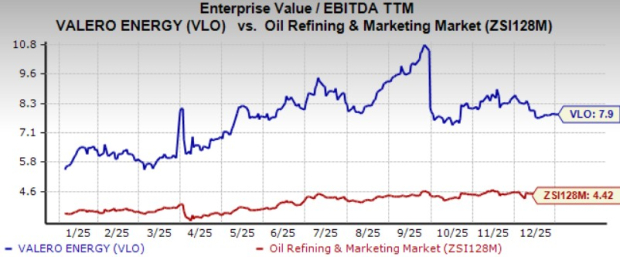

**Valero Energy Corporation (VLO) trades at a trailing 12-month EV/EBITDA of 7.90x**, significantly above the industry average of 4.42x, raising questions about its premium valuation. Currently, WTI oil prices are below $60 per barrel, lower than a year prior, which presents a mixed outlook for the energy sector. Despite a challenging environment, Valero, with a refining capacity of 3.2 million barrels per day, stands to benefit from lower crude oil costs and increasing global inventories, as projected by the U.S. Energy Information Administration (EIA).

In the past year, VLO’s stock has shown a 39.6% gain, outperforming the industry’s 18.5% and exceeding Phillips 66’s 17.7% increase. However, Valero’s dividend yield is at 2.73%, below the industry average of 3.86%, which may deter some investors. Analysts suggest holding VLO shares but caution against investing at current premium levels.