“`html

Axon Enterprise Performance Overview

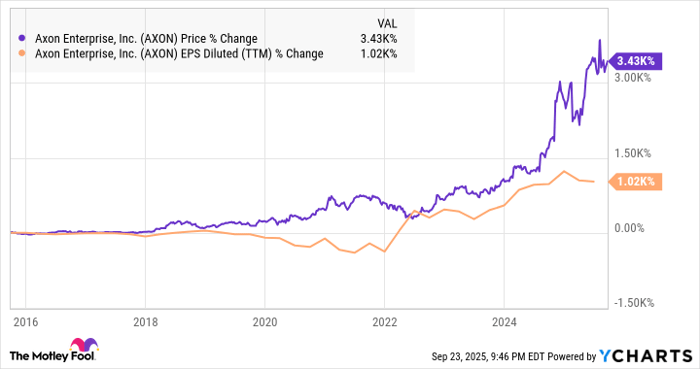

Axon Enterprise (NASDAQ: AXON) has seen its stock price surge over 3,000% over the last decade. In its most recent second quarter, the company reported a 33% revenue increase, reaching $669 million, alongside an adjusted net income of $174 million. The company continues to innovate with new products while undergoing an investment phase in technologies like AI.

As of now, Axon trades at a price-to-earnings ratio of 110 after a 20% decline from its all-time high. Despite a GAAP operating loss of $9.8 million in the first half of 2025, Axon remains considered fairly valued due to its strong market presence and unique business model.

“`