Apple Inc. (NASDAQ: AAPL) reported a significant fiscal Q1 2026 revenue increase of 16%, totaling $143.76 billion, surpassing analyst expectations of $138.48 billion. The company’s earnings per share rose 19% to $2.84, outperforming the consensus estimate of $2.67. Notably, iPhone sales made up nearly 60% of total revenue, climbing 23% to $85.27 billion, significantly exceeding expected sales of $78.65 billion.

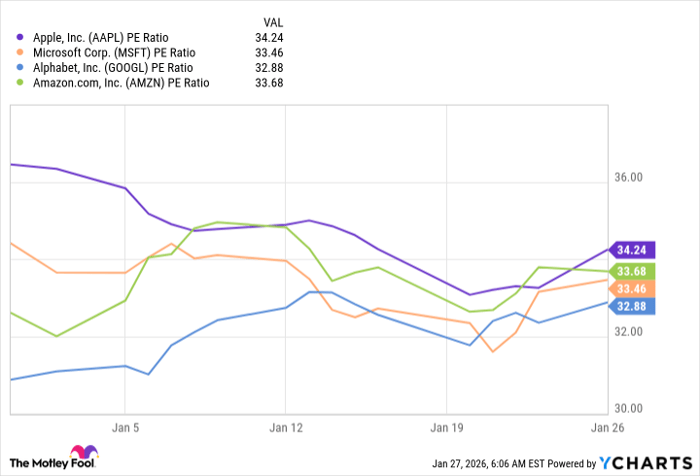

Sales were mixed in other product categories; iPad sales grew by 6% to $8.6 billion, while Mac sales fell by 7% to $8.4 billion, and wearables revenue dropped by 2% to $11.5 billion. The company saw strong growth in China, with revenue up 38%. Apple expects revenue growth of 13% to 16% year-over-year in Q2, driven largely by its services segment, which rose 14% to $30 billion. Despite improved sales and operational momentum, Apple’s stock price has remained stable, raising questions about its future growth potential.