The J. M. Smucker Company SJM is showing strength in a changing market, proving its resilience through core brand performance and smart strategies. Brands like Uncrustables, Meow Mix, Cafe Bustelo, and Jif have helped the company experience growth in organic net sales and earnings during the second quarter of fiscal 2025.

Key Drivers Behind The J. M. Smucker’s Success

The J. M. Smucker is focused on its strategic goals, which include boosting volume and net sales while emphasizing operational excellence. A significant aspect of this strategy is the integration of Hostess, acquired in November 2023, enhancing its position in the sweet baked goods market.

Despite facing some immediate challenges, the company views this acquisition as essential for long-term growth and plans to exploit synergies in both retail and away-from-home markets. SJM aims to achieve greater transformation, cost discipline, and cash generation, emphasizing sustainable growth in pet food, coffee, and snacking categories.

As part of its portfolio reevaluation, the company has divested its Voortman business to Second Nature Brands, sold its Canadian condiments business in January 2024, and Sahale Snacks in November 2023. These strategic sales are intended to sharpen its focus on core growth areas.

In the Coffee segment, SJM reports steady growth, achieving a 3% increase in sales last quarter thanks to successful pricing strategies and strong brand loyalty. The Cafe Bustelo brand outperformed with a 20% sales rise, while Folgers saw a 5% increase, indicating sustained demand. With balanced pricing and consumer affordability strategies, the Coffee segment continues to be a key contributor to growth.

Management anticipates a fiscal 2025 net sales growth of 7.5%-8.5%, driven largely by Uncrustables, Milk-Bone, Meow Mix, and Cafe Bustelo, all projected to maintain momentum. The adjusted gross profit margin is anticipated to sit between 37.5% and 38%, bolstered by cost efficiencies and an advantageous product mix.

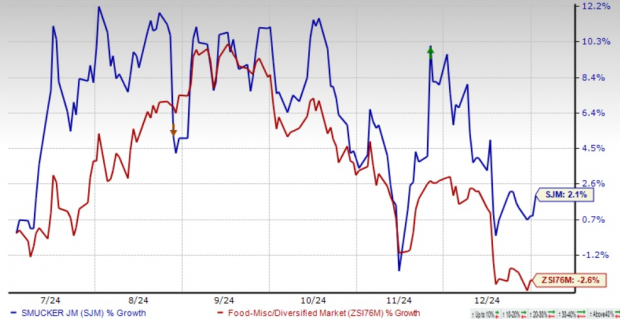

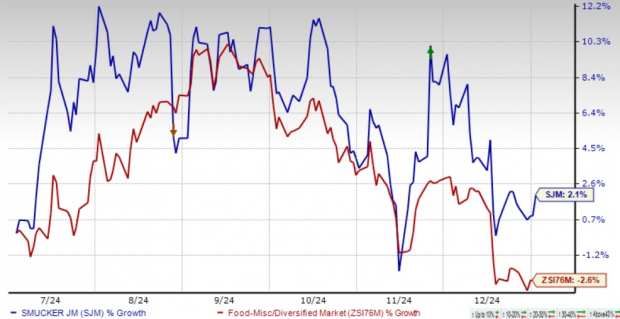

SJM Price Trends Compared to Industry

Image Source: Zacks Investment Research

Challenges Ahead for SJM

The J. M. Smucker is adapting to a difficult consumer environment marked by inflation and decreasing discretionary spending, which are altering shopping habits. These changes are particularly challenging for the sweet baked goods segment, where the recovery has been slower than hoped. Consequently, management has revised its outlook, expecting net sales in the Sweet Baked Snacks unit to hit around $1.3 billion for fiscal 2025, a reduction of $60 million from previous estimates.

Cost inflation and high selling, distribution, and administrative (SD&A) expenses are further squeezing profitability. The J. M. Smucker is sensitive to fluctuations in commodity costs, especially in its Coffee and Pet Food divisions. Although pricing strategies are in place to mitigate these pressures, ongoing increases in raw material, transportation, and production costs remain threats to profitability. SD&A expenses are predicted to rise by approximately 9% in fiscal 2025 due to higher marketing expenditures, resulting in a projected mid-single-digit decline in adjusted EPS for the third quarter.

Closing Thoughts on The J.M. Smucker Stock

The J.M. Smucker’s strong brand portfolio, strategic acquisitions, and solid performance in the coffee and pet food markets indicate a promising growth trajectory. However, challenges like cost pressures and slow recovery in certain segments lead to a cautious outlook. The company’s ability to implement effective strategies and maintain focus on high-growth categories will be vital for sustained success.

Shares of this Zacks Rank #3 (Hold) company have increased by 2.1% in the past six months, contrasting with the food industry’s decline of 2.6%.

Promising Alternatives to Consider

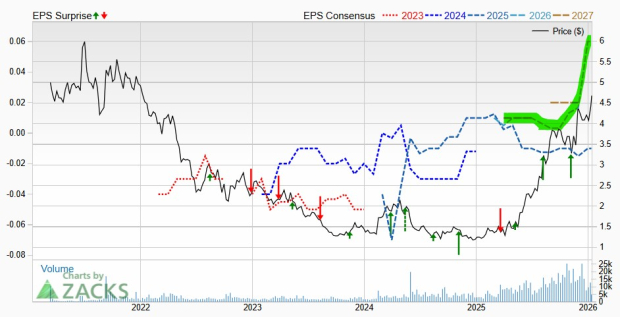

Highlighted below are three stocks with better rankings: United Natural Foods, Inc. UNFI, Ingredion Incorporated INGR, and Freshpet FRPT.

United Natural holds a Zacks Rank of 1 (Strong Buy), with a remarkable trailing four-quarter earnings surprise of 553.1%. The current estimates suggest year-over-year growth of 0.3% in sales and 442.9% in earnings.

Ingredion, carrying a Zacks Rank of 2 (Buy), specializes in sweeteners and starches derived from corn and other starch-based materials. Its trailing four-quarter earnings surprise averages 9.5%, with a forecasted earnings growth of 12.4% for the current fiscal year.

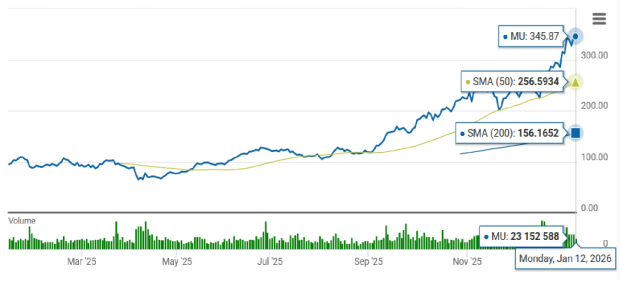

Freshpet, also rated Zacks Rank 2, stands out in the pet food industry with a trailing four-quarter earnings surprise of 144.5%, along with anticipated sales and earnings growth of 27.2% and 228.6% respectively.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, five Zacks experts selected their top pick capable of soaring +100% or more in the upcoming months. Director of Research Sheraz Mian has highlighted one stock with exceptional upside potential.

Targeting millennial and Gen Z consumers, this company generated nearly $1 billion in the last quarter. A recent stock dip presents a timely buying opportunity. While not every pick may succeed, this one holds promise, potentially exceeding previous outperformers like Nano-X Imaging, which surged +129.6% in just over nine months.

Free: See Our Top Stock And 4 Runners Up

The J. M. Smucker Company (SJM): Free Stock Analysis Report

Freshpet, Inc. (FRPT): Free Stock Analysis Report

United Natural Foods, Inc. (UNFI): Free Stock Analysis Report

Ingredion Incorporated (INGR): Free Stock Analysis Report

Read this article on Zacks.com.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.