Understanding Stock Recommendations: An Insight into Marvell Technology

Investors often refer to analyst recommendations when deciding on stocks. But how much weight should they give these suggestions? Before diving into the reliability of these ratings, let’s examine what analysts currently say about Marvell Technology (MRVL).

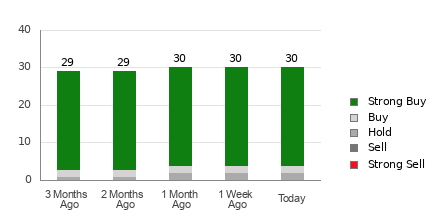

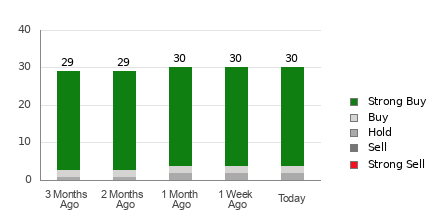

Marvell holds an average brokerage recommendation (ABR) of 1.20 on a scale from 1 to 5, where 1 is “Strong Buy” and 5 is “Strong Sell.” This figure is based on 30 recommendations from various brokerage firms. An ABR of 1.20 signals a consensus leaning towards Strong Buy.

Out of these 30 recommendations, 26 are categorized as Strong Buy, while two fall under Buy. Collectively, this means that 86.7% of the recommendations favor Strong Buy compared to 6.7% for Buy.

Current Trends in Brokerage Recommendations for Marvell

Access Marvell’s price target and stock forecast here>>>

While the current ABR suggests buying Marvell, relying solely on this metric for investment decisions is not advisable. Research indicates that brokerage recommendations frequently lack the credibility needed to guide investors effectively towards stocks poised for significant price increases.

Why is this the case? Brokerage firms often have a vested interest in the stocks they cover, leading analysts to exhibit a strong positive bias in their ratings. Studies show that for every “Strong Sell” rating, there are around five “Strong Buy” ratings issued by these analysts.

This misalignment of incentives means that these recommendations often do not reflect the true potential price movements of the stock. Hence, the best approach may be to use this information to support your own research or complement other indicators that have demonstrated historical effectiveness in forecasting stock performance.

Zacks Rank, a proprietary stock rating tool, effectively categorizes stocks into five ranks ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell). This model is particularly adept at predicting short-term stock price performance based on earnings estimate revisions, making it a valuable resource for investors.

Distinguishing Between Zacks Rank and ABR

It’s important to note that while both Zacks Rank and ABR are scored on a scale of 1 to 5, they represent distinct metrics.

ABR is computed solely from analyst recommendations and is typically presented in decimal form (e.g., 1.28). Conversely, the Zacks Rank is rooted in a quantitative model that focuses on earnings estimates and is represented in whole numbers.

Brokerage analysts have historically been overly optimistic in their ratings. Because these ratings frequently skew towards the positive due to their firms’ interests, they can mislead investors rather than provide accurate guidance.

In contrast, earnings estimate revisions are a fundamental component of the Zacks Rank. Numerous studies have illustrated how changes in earnings estimates correlate strongly with stock price fluctuations in the near term.

Moreover, the Zacks Rank maintains proportionality across all stocks covered by analysts, ensuring a fair distribution of scores across its five ranks.

An additional distinction is the timeliness of these ratings. The ABR may not always reflect the most current data. However, analysts constantly update their earnings estimates to mirror changing economic conditions, resulting in a more immediate indicator of future stock performance via the Zacks Rank.

Is It Wise to Invest in MRVL?

The Zacks Consensus Estimate for Marvell has increased by 15.5% over the last month, reaching $1.56. This upward trend points to a growing optimism among analysts regarding the company’s earnings potential, suggesting the stock could experience significant growth in the near future.

The considerable shift in the consensus estimate, along with other related factors, has earned Marvell a Zacks Rank of #1 (Strong Buy). You can see the full list of today’s Zacks Rank #1 stocks here >>>>

Thus, while the Buy equivalent ABR for Marvell can guide investors, it is wise to consider it alongside other analyses.

Zacks Shares Top 10 Stock Picks for 2025

Are you looking for insights on the best stocks to buy for the upcoming year?

Past performance indicates remarkable outcomes. From 2012 to November 2024, the Zacks Top 10 Stocks portfolio surged by +2,112.6%, significantly outperforming the S&P 500, which rose +475.6%. As our Director of Research, Sheraz Mian, reviews 4,400 companies, he aims to select the top 10 stocks to invest in for 2025. Stay tuned for their release on January 2.

Be the First to Discover the New Top 10 Stocks >>

Get your Free Stock Analysis Report for Marvell Technology, Inc. (MRVL).

Read this article on Zacks.com.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.